Emirates NBD Profits Q1 2026

You can find out Emirates NBD Profits Q1 2026 by the following information:

- Emirates NBD’s profit before tax raised by 56% compared to the first quarter of 2024.

Emirates NBD Financial Review

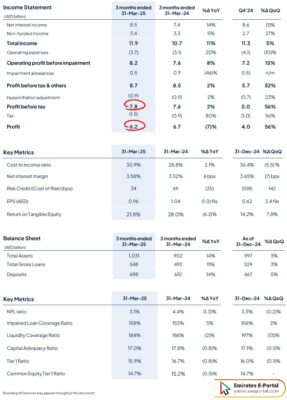

You can find out Financial Review of Emirates NBD for Q1 2026 by the following table:

| Income Statement (AED billion) | Three months ending March 31, 2026 | Three months ending March 31, 2024 5 | Compared to the same period of the previous year | Compared to the fourth quarter of 2025 | Compared to the previous quarter |

| Net Interest Income | 8.5 | 7.4 | 14% | 8.6 | 1% |

| Non-Funded Income | 3.4 | 3.3 | 5% | 2.7 | 27% |

| Total Income | 11.9 | 10.7 | 11% | 11.3 | 5% |

| Operating Expenses | 3.7 | 3.1 | 20% | 4.1 | 10% |

| Operating Profit Before Impairment | 8.2 | 7.6 | 8% | 7.2 | 15% |

| Impairment allowances | 0.5 | 0.9 | 46% | 1.5 | n\m |

| Profits Before Tax and Others | 8.7 | 8.5 | 2% | 5.7 | 52% |

| Hyperinflation Adjustment | 0.9 | 0.9 | 2% | 0.7 | 23% |

| Profits Before Tax | 7.8 | 7.6 | 2% | 5 | 56% |

| Tax | 1.5 | 0.9 | 80% | 1% | 56% |

| Profits | 6.2 | 6.7 | 7% | 4 | 56% |

Emirates NBD Financial Review PDF

You can download Emirates NBD Financial Review pdf “from here“. In the file, you can find details of changes in Emirates NBD’s profits and compare them with the same period last year and with the previous quarter.

Questions & Answers

What is the reason for the rise in Emirates NBD Profits Q1 2025?

driven by significant loan growth driven by regional expansion, a low-cost financing base, and a large transaction volume.

What is the value of Emirates NBD's assets for the first quarter of 2025?

The value of Emirates NBD's assets for the first quarter of 2025 exceeded one trillion Emirati dirhams.

What is the percentage increase in total income at Emirates NBD Bank Q1 2025?

Total income increased by 5% to 11.9 billion AED .

What is Emirates NBD's net interest margin in Q1 2025?

Emirates NBD's net interest margin for Q1 2025 is 3.58%.

How much Emirate NBD loan growth in Q1-25?

Emirate NBD loan growth in Q1-25 is 3.5%

Share