Zakat Calculator UAE – Accurate & Easy Online Tool 2026

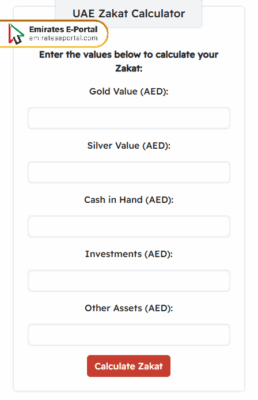

To calculate zakat in the UAE, you can use the following calculator:

Zakat Amount:

What is Zakat and Why it Matters in the UAE

It is among the five pillars of Islam, and it requires every Muslim who possesses some wealth beyond their need to share some amount thereof in charity for the considered poor. Zakat is a great option for social welfare and economic equity in the UAE. Through zakat, community development is enhanced, and it ensures that the excess wealth goes into support for the poorer sections of society.

How to Calculate Zakat on Gold, Silver, and Cash

Calculations for Zakat on gold, silver, and cash start with their valuation against the Nisab limit, and if the combined aggregate value is an amount higher than the Nisab limit value, Zakat becomes payable at 2.5% on the total value. A lunar year at minimum should elapse between the time of holding these items and the time of Zakat calculation. Use the latest market values for gold and silver and include all your liquid savings in the calculation.

How to Use a Zakat Calculator Step

To use a Zakat calculator Step by Step, Just follow these easy steps:

- Fill in all blanks with correct information.

- Verify the validity of the entered data.

- Click on the Calculate Zakat icon at the bottom.

- Check the amount of zakat that must be paid.

Common Mistakes to Avoid When Calculating Zakat

Here are several common mistakes to avoid when calculating zakat:

- Ignoring All Asset Types: Many from the listing of assets will exclude stocks, business inventory, or rental income from Zakah calculation. All wealth held for one lunar year needs to be taken into consideration, so one does not underpay his or her dues.

- Using Outdated Gold or Silver Rates Ignore: This leads to wrong values assigned to the Nisab, because one would not check for current rates for gold or silver. Always keep yourself updated with the current prices to determine if you must give Zakah.

- Improper Nisab calculation: Some use cash alone to calculate the Nisab and exclude considerations of gold or silver. It is important to apply one of the two standards-weighing on gold or silver, whichever is beneficial to the majority-for the determination of real Zakah eligibility.

- Not Deducting Legitimate Debts: Not deducting outstanding debts from the total worth inflates the Zakah amount, so this is a mistake. Credible short-term debts due within a year should always be deducted to serve as representation of actual Zakah wealth.

- Paying Late: This is a common error as there is always some excuse behind the delay. Zakat is to be paid without any delay after it has become due, and under no condition (except for valid reasoning) should one deliberately postpone it; such an act in the eyes of Islam constitutes a grave disregard for the rights of God.

Understanding Nisab Thresholds in UAE

Nisab refers to the minimum amount of wealth that one must own before they become liable to pay Zakat. The typical calculations in the UAE are done based on the current value of 85 grams of gold or 595 grams of silver. Individuals declare their assets yearly, upon which they must calculate whether their wealth meets or crosses the mandatory giving threshold.

Zakat on Property and Rental Income Explained

Zakat is not due on personal residential properties. If, however, one owns a property for investment or rental purposes, Zakat will be imposed on the income generated, not on the market value of the property. A rate of 2.5% of the net annual rental income is to be considered, having deducted from that any essential maintenance and operational expenses that may have been borne during the course of the year.

Who is Eligible to Receive Zakat?

Zakat recipients must fall under any of the eight categories mentioned in Islamic law; for example, the poor and the destitute, or in debt and others as mentioned in the Qur’an. In the Emirates, also, charitable organizations officially pick and distribute Zakat to ensure that the worthy goad and needy families, including the low-income groups and refugees, receive genuine assistance.

Zakat al-Mal vs. Zakat al-Fitr: Key Differences

The following points explain the main differences between Zakat al-Mal and Zakat al-Fitr:

- Differences: Zakat al-Mal purifies the wealth after some accumulation through a year, while Zakat al-Fitr purifies fasting and is intended for alms-giving support for the needy before Eid. Therefore, they vary in time and aim.

- Eligibility Requirements: Zakat al-Mal is for individuals whose assets exceed the Nisab threshold. Zakat al-Fitr, however, must be paid for every Muslim, rich or poor, from themselves or for their dependents.

- Calculation Method: Zakat al-Mal accounts for 2.5% of one’s qualifying wealth after one lunar year, whereas Zakat al-Fitr is generally a fixed, predetermined amount corresponding to the price of generic staple food per family member.

- Payment Timing: Zakat al-Mal undergoes payment after the passage of one year since the assets have come into possession, while Zakat al-Fitr is paid sometime before the beginning of the Eid prayer. In case of late payments of Zakat al-Fitr, such payments cease to maintain its objectives in the religious sense and remain valid for the benefit of those intended.

- Recipients: Both distribute to the needy, but Zakat al-Fitr is intended to help the poor few enjoy Eid. Zakat-al-Mal has much broader categories for its recipients, including the indebted, travelers, and administrators of Zakat.

How to Pay Zakat Online in the UAE

With a few simple steps and by clicking on official portals, zakat can be paid electronically in the United Arab Emirates using secure methods. There are several government portals and Islamic banks, such as the Zakat Fund, Dubai Islamic Bank, and Emirates Islamic. Through these portals, zakat payers can enter their asset details and specify the amount due. Thus, the payment process can be completed in just a few minutes via the internet or mobile phone.

Questions & Answers

Zakat in the UAE and worldwide is calculated based on 2.5% of the wealth that has reached the nisab and has been held for a full year.

If the nisab is 20,000 UAE dirhams, the zakat is 500 UAE dirhams.

You can calculate the amount of zakat you will pay using the zakat calculator.