Zakat Al Fitr Calculator in UAE

You can Calculate Zakat Al Fitr in UAE by Zakat Calculator provided by Zakat Fund website by the link listed below:

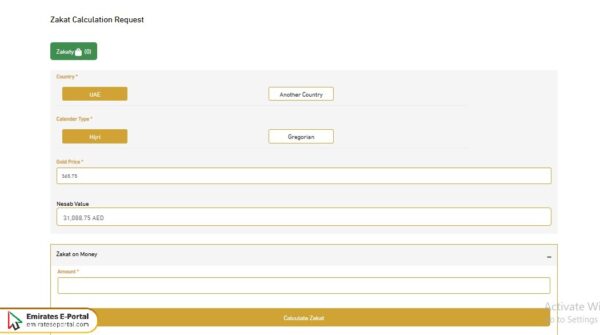

Steps to Calculate Zakat Al Fitr on Money

You can Calculate Zakat Al Fitr on Money by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Money” tab.

- Enter the amount for which Zakat will be calculated in the designated field.

- Click the “Calculate Zakat” button.

- View the Zakat amount due on the money.

Read More: Zakat Al Fitr Amount | Pay Zakat Al Fitr Online

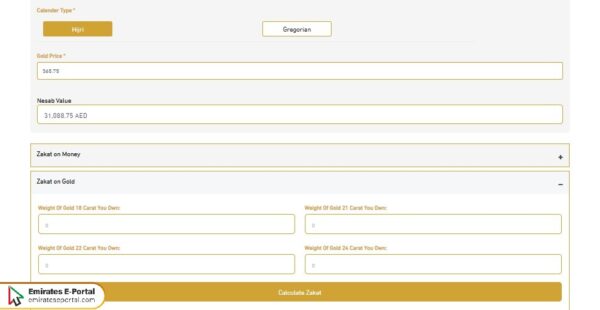

Steps to Calculate Zakat Al Fitr on Gold

You can Calculate Zakat Al Fitr on Gold by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Gold” tab.

- Enter the weight of 18-karat gold in the appropriate field.

- Enter the weight of 21-karat gold in the designated box.

- Enter the weight of 22-karat gold in the adjacent field.

- Enter the weight of 24-karat gold in the appropriate box.

- Click the “Calculate Zakat” option.

- The zakat value, total amount, and nesab value due on the gold will appear.

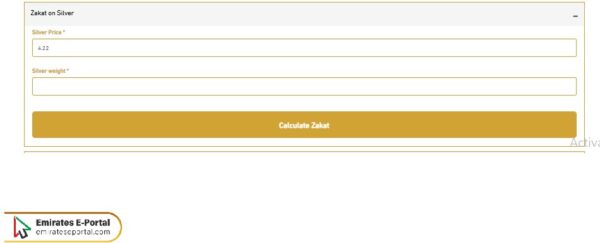

Steps to Calculate Zakat Al Fitr on Silver

You can Calculate Zakat Al Fitr on Silver by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Silver” tab.

- Enter the weight of the silver in the designated field.

- Click the “Calculate Zakat” option.

- The zakat value, total amount, and nesab (minimum threshold) for the silver will appear.

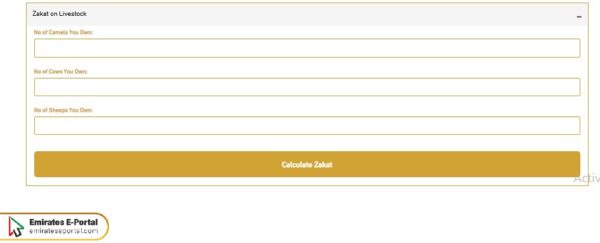

Steps to Calculate Zakat Al Fitr on Livestock

You can Calculate Zakat Al Fitr on Livestock by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Livestock” tab.

- Enter the “number of camels you own” in the appropriate field.

- Enter the “number of cows you own” in the designated box.

- Enter the “number of sheep you own” in the adjacent field.

- Click the “Calculate Zakat” option.

- The zakat value, total amount, and the nesab (minimum threshold) for livestock will appear.

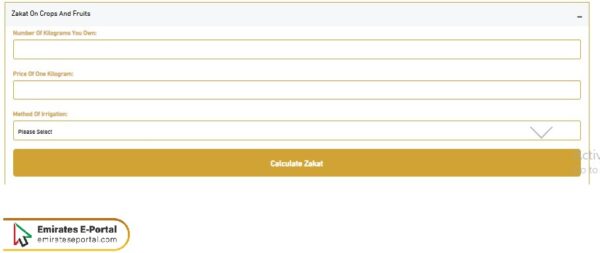

Steps to Calculate Zakat Al Fitr on Crops And Fruits

You can Calculate Zakat Al Fitr on Crops And Fruits by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Crops And Fruits” tab.

- Enter the “number of kilograms you own” in the designated field.

- Enter the “price per kilogram” in the designated field.

- Choose the irrigation method (without cost, without cost, both methods alike).

- Click on the “Calculate Zakat” option.

- The zakat value, total amount, and the nesab due on crops and fruits will appear.

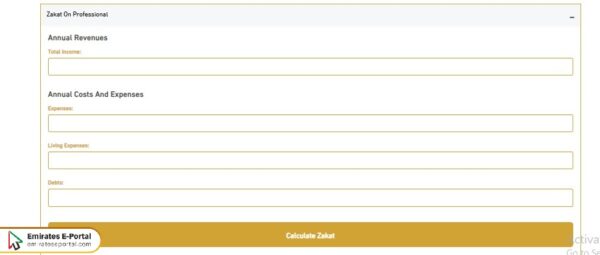

Steps to Calculate Zakat Al Fitr on Professional

You can Calculate Zakat Al Fitr on Professional by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Professional” tab.

- Add the value of annual income or total income in the designated field.

- Add the value of annual costs and expenses in the designated fields, including Expenses, living expenses, and debts.

- Click on the “Calculate Zakat” option.

- The zakat value, total amount, and the nesab required for freelance professions will appear.

Steps to Calculate Zakat Al Fitr on Dates

You can Calculate Zakat Al Fitr on Dates by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Dates” tab.

- Select the emirate from the list (Abu Dhabi, Dubai, Sharjah, Ajman, Umm Al Quwain, Ras Al Khaimah, Fujairah).

- Select the region and add it to the appropriate box.

- Select the date type in the appropriate box.

- Add the number of fruit trees in the designated box.

- Choose the irrigation method (without cost, without cost, both methods alike).

- Click the “Calculate Zakat” option.

- The zakat value, total amount, and the nesab (minimum threshold) for dates will appear.

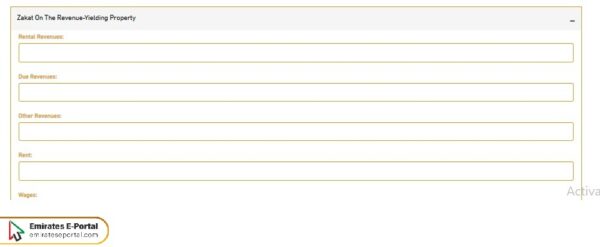

Steps to Calculate Zakat Al Fitr on The Revenue-Yielding Property

You can Calculate Zakat Al Fitr on The Revenue-Yielding Property by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on The Revenue-Yielding Property” tab.

- Enter the Rental Revenues in the designated field.

- Enter the Due Revenues value in the designated field.

- Enter the Other Revenues value in the designated field.

- Enter the rent value in the designated field.

- Enter the wage value in the designated field.

- Enter the taxes value in the designated field.

- Enter the Payable Debts value in the designated field.

- Enter the other expenses value in the designated field.

- Enter the living expenses value in the designated field.

- Click the “Calculate Zakat” option.

- The zakat value, total amount, and the nesab value due on the properties will appear.

Steps to Calculate Zakat Al Fitr on Companies

You can Calculate Zakat Al Fitr on Companies by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Companies” tab.

- Enter the required information in the designated fields, such as selecting the company and adding its details.

- View the zakat amount.

Steps to Calculate Zakat Al Fitr on Shares

You can Calculate Zakat Al Fitr on Shares by following the simple steps below:

- Go to the Zakat Calculation Request page “from here“.

- Select the country “United Arab Emirates“.

- Select Calendar Type “Hijri” or “Gregorian“.

- Learn the price of gold and the nesab Value.

- To calculate Zakat on money, follow these steps:

- Click the “Zakat on Shares” tab.

- Enter the required information in the designated fields.

- The zakat value, total amount, and the nesab value due on the shares will appear.

Questions & Answers

2.5 kilograms of rice is the amount of Zakat al-Fitr in the UAE.

By multiplying the amount of money that has been held for a year by 2.5% or by dividing it by 40.

The amount of Zakat al-Fitr varies depending on the type of money. The amount of Zakat al-Fitr for money is 25 AED per person.

The amount of Zakat al-Fitr is 25 UAE dirhams per person.

The zakat Nesab is one sa' of the country's staple food for each Muslim, which is equivalent to 2.5 kg of rice or 25 UAE dirhams.