SIP Calculator UAE 2026 – Estimate Your Investment Growth

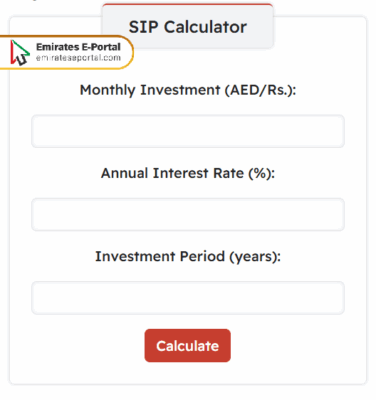

SIP account in UAE You can use the following calculator:

What is SIP

SIP, or Systematic Investment Plan, is a disciplined way of investing where investors invest a sum regularly into mutual funds. An SIP helps investors with gradual wealth accumulation while reducing the risk of timing the market. SIPs are suitable for residents in the UAE looking at long-term financial goals such as retirement, education, or homeownership. Making monthly investments through SIP builds consistent, affordable, and benefit-from-compounding relationships between the investor and fund.

How to Use SIP Calculator in UAE

To use SIP calculator in the UAE, Here’s what you need to do:

- Type Monthly Investment in the field provided.

- Enter the Annual Interest Rate.

- Add Investment Period in the designated field.

- Click on the calculate icon to see the result.

Benefits of Mutual Fund SIP Calculator

The following list highlights the benefits of SIP calculator for mutual funds:

- Generate Accurate Return Estimates: Through a fixed sum for monthly contribution, tenure, and interest rate, the calculator accurately estimates the investment returns, allowing the investor in the UAE to plan efficiently without complicated manual calculations.

- Saves Time and Effort: Instead of wasting precious time with complicated formulas, the SIP calculator will promptly make results, saving your efforts and chances of committing mistakes all at once for busy professionals and investors in the UAE.

- Helps in Plan Comparisons: The calculator allows you to simulate mutual fund schemes by varying your SIP amounts and durations, enabling you to choose the best plan on the basis of return potential and risk preference.

- Visual Tracking of Growth: Many calculators draw charts or tables that represent the growth of your SIP investment over time, making it more comfortable for you to visualize wealth accumulation and track your savings in terms of monthly and yearly increase.

- Informs Monthly Budgeting: The moment you know how much you must put in monthly, adjustments could be made toward expenses so that the budget effectuates SIP contributions without infringing on lifestyle or financial standing.

What are the types of SIP in UAE

In the UAE, Fixed SIP is the most common type, where investors contribute a fixed amount regularly, typically monthly. This helps in disciplined investing & suits salaried individuals. A flexible SIP scheme could also be designed so that the investor increases or decreases the contribution/subscription amount according to the financial situation. This provision helps in accommodating changes in income or expenses over a period of time.

Top-up SIP is another option in the UAE, where investors can increase their SIP contributions periodically, supporting wealth growth as income rises. There’s also Perpetual SIP, which continues indefinitely until stopped manually. Trigger SIP is less common but allows investment based on specific market or date triggers. These types offer flexibility & customization for varying investment strategies.

How Does an SIP Return Calculator Help You

The following points explain how the SIP Return Calculator can help you:

- Instant ROI Calculation: The moment you input the amount, interest rate, and duration, this SIP calculator calculates that amount as your returns from the SIP and assists in determining the right plan in the UAE for investing.

- Supports Financial Decisions: This calculator helps your determination whether your current SIP approach will fulfill your purposes or whether something will have to change with respect to your monthly contribution or investment length for a better financial outcome.

- Avoiding Miscalculations: Calculating the ROI manually often leaves premises for mistakes. A SIP return calculator, instead, through its correct formulas and automation, provides precise results that help you avoid misjudging your course of financial planning.

- Builds Consistency: Seeing the gradual growth of investment through the calculator reiterates the significance of remaining consistent with SIPs. Such information energizes you to continue regular investments to achieve the wealth expected in the long run.

Questions & Answers

The best SIP in the UAE depends on your financial goals and risk tolerance.

If you do a SIP with AED 10,000 every month for 10 years in the UAE, your returns would be dependent on the If you invest 10,000 AED/Rs. in a SIP for 10 years in the UAE, your returns will depend on the fund’s performance. With an average 10% annual return, you could earn around AED 2,065,520.