UAE Salary Calculator – Updated with Latest Rules for 2026

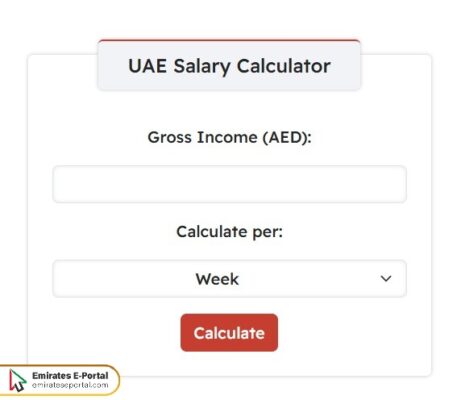

You can use the following calculator to calculate your salary in the UAE:

How to Use a UAE Salary Calculator

To use a UAE salary calculator online, Here’s what you need to do:

- Write Gross Income in the upper field in UAE Dirhams.

- Calculate per year, month, or week.

- Click on the calculate icon to see the result immediately.

Key Features of Advanced UAE Salary Calculators

The following list highlights the key features of advanced payroll calculators in the UAE:

- Detailed Gross-to-Net Breakdown: Advanced calculators provide the separation of gross income and all sorts of deductions such as housing, transport, bonuses, gifts, and so forth, giving the person on the street an exact figure of his real income in his hands, which he can then compare with some or other sums in the budgets and plan for life ahead.

- Custom Allowance Inputs: Users can input a variety of allowances manually such as housing, fuel, or phone to make calculations more customized and pertinent to individual contracts or job offers.

- Tax and Pension Contributions: These tools deduct pension contributions for UAE nationals and provide something tax-free for the expatriates, thereby reflecting a unique salary situation in the UAE.

- Multiple-Currency Conversion: Advanced calculators allow for conversion between AED and other currencies, uncommon for expats who would like to weigh an overseas offer or host some international financial obligations.

- Comparison Tools for Jobs or Offers: Some calculators allow users to enter two offers side by side, thereby speeding up data-driven decisions for career choice when comparing packages for employment in the UAE.

Understanding Gross vs. Net Salary in the UAE

In the UAE, gross salary means everything you earn before any deductions are made, including basic salary, allowances, & bonuses. Net salary is what you receive after all the deductions are made, which could be pension contribution for an Emirate or any other agreed deductions for an expatriate. For your own budgeting, financial planning, & on an application or offer basis, it is important for you to know your gross & net salaries.

Impact of Social Security Contributions to UAE Nationals

UAE nationals contribute 5% of their salary to the General Pension and Social Security Authority, while employers contribute an additional 12.5% to 15%. This deduction is compulsory and impacts the net salary of Emirate employees. Unlike expats, Emirates have to factor this one before calculating take-home pay; this thus makes salary calculators especially helpful when it comes to making an accurate financial estimate.

Why Salaries Vary Across Different Emirates in the UAE

The following points explain why salaries vary across different emirates in the UAE.

- Cost of Living Adjustments: Salary structures vary across emirates based on cost of living in those regions. For example, jobs in Dubai or Abu Dhabi may pay higher to rival the cost of housing and commuting.

- Housing Allowances Variations: In some emirates, companies tend to provide higher housing allowances to attract talent; thus, impacting overall compensation and standards of living.

- Type of Industry Hubs: In oil and gas, Abu Dhabi may stand at a superior side of the spectrum, while Dubai may pay a premium for finance and technology, depending more on each emirate’s economic specialization.

- Travel and Transport Allowances: Employers up north may give allowances and soft working hours to make the long-distance commute easier, subtly hurting the total salary of working at a more remote venue.

- Demand-Supply Effect: Every place whose demand for manpower is high usually becomes an arena for competitive salaries, while quieter emirates tend to offer a lesser salary, compensated, or remains with the government.

How Housing Allowances Affect Your Net Income

Housing allowances, when included in the gross salary, vary from employer to employer and also across locations. While it adds positively to the overall salary package, it does not necessarily mean cash in hand with company-provided housing. For employees who are provided actual housing allowances in cash, it enhances their net income. In order to gauge actual earnings, be sure to find out what the allowances entail in terms of tax or structure.

Benefit of Using Salary Calculators for Contract Negotiations

The following points illustrate the benefits of using payroll calculators in contract negotiations:

- Setting Realistic Salary Expectations: Calculators assist in setting expectations by revealing what is actually expected to get home in a paycheck, making possible the acceptance or contesting of a certain employer’s offer.

- Confidence During Negotiations: If armed with all details of income breakdowns, you can bargain for tax allowances or basic pay based on facts rather than assumptions, boosting your credibility in HR discussions.

- Hidden Deductions: Salary calculators will expose deductions such as loan payments or housing allowances. You can inquire about such issues and avoid unpleasant surprises after signing a contract.

- Comparing Different Offers: These tools make evaluating offers side by-side easy, assisting in making the best choice between total packages versus base executions only.

- Maximizing Net Income: By breaking down the contributions to net pay, one is able to steer discussions towards arguing for items that are negotiable like transport or meal allowances over a mere increase in base.

Common Mistakes to Avoid When Using Salary Calculators

Below is a list of common mistakes to avoid when using payroll calculators:

- Ignoring Allowance Structure: Many users forget to include allowances or simply do not classify the allowance properly, such as rent or transport allowance, and this leads to an underestimation or overestimation of the final salary.

- Entering Gross as Net or Vice Versa: A common mistake is to enter data in the gross field when it should be in the net field, or vice versa, with the consequence that results are skewed and poor financial or career decisions might ensue.

- Without Deducting the Contributions for Emiratis: Emirates nationals have to deduct pension contributions, and failing to do so presents an inaccurate picture as to what the net salary is.

- Assuming Some Tax Deductions: Some persons erroneously think because income tax is levied in other countries, it should also apply in the UAE; this misconception leads to distorted salary expectations since the income is tax-free.

- Local versus Global: Most of the global salary calculators do not abide by the UAE tax-free and allowance-heavy structure; thus, it is essential to use regionally accurate platforms.

Questions & Answers

You can calculate salary in the UAE by multiplying the salary by the specified period. If the monthly salary is AED 5,000, the monthly salary is 5,000 x 12, which equals AED 60,000.

Yes, $15,000 is a good salary in Dubai.

The salary calculator in the UAE is used to obtain accurate financial results.