ROI Calculator Dubai 2026 – Know Your Profit Before You Invest

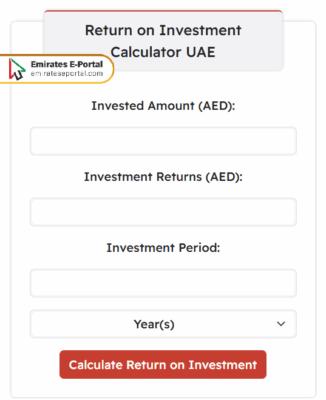

To calculate ROI in the UAE, you can use the following calculator:

| Result Type | Value (AED) |

|---|---|

| Investment Amount: | AED |

| Total Amount Gained on Investment: | AED |

| Invested Amount: | AED |

| Return on Investment (ROI): | % |

| Annual Growth Rate: | % |

What is a Good ROI in the UAE

A good ROI in the UAE usually ranges between 5% and 8% pa, depending on the type and situation of the investment. In real estate, Dubai and Abu Dhabi generally enjoy more returns compared to those of other emirates. For many investors, whose capital is being committed into the UAE market, ROI is one important indicator to judge performance and see opportunity.

Calculate Your Investment Returns in the UAE

How do you calculate investment returns in the UAE? ROI = (Net Profit / Cost of Investment) × 100. This simple formula gives you a percentage that tells how much profit you are making for every unit of money invested. Many online ROI calculators exist now to work on property or business investment matters, which provide a straightforward insight into free investment options throughout various sectors in the UAE.

How to Use Real Estate ROI Calculator in UAE

To use real estate ROI calculator in the UAE, Just follow these easy steps:

- Write Invested Amount in UAE Dirhams.

- Enter Investment Returns in AED.

- Type Investment Period and then select years or months from the list.

- Click on the Calculate Return on Investment icon.

Understanding the Terms Used in ROI calculations in UAE

The following list helps you understand the terms used in ROI calculations in the UAE:

- Net Profit: This would be the net accumulation of money that remains after all expenses, taxes, and fees have been deducted from returns on investments. This is an essential number in any UAE investment to compute for real ROI.

- Initial Investment: This is the total capital initially spent on an asset or project, inclusive of the purchase price, fees, and any associated costs. ROI is invariably calculated in relation to this figure.

- Annual Yield: This term usually finds its use in property investment and means the income per annum (usually rent) expressed as a percentage of the total property cost. It is different from the full ROI but relevant nevertheless.

- Capital Appreciation: It is the increase in asset value over time. On the UAE property front, Dubai Hills and similar areas have enjoyed a steady rate of capital appreciation, which affects long-term ROI.

- Gross vs. Net ROI: While gross ROI does not consider expenses, net ROI becomes inclusive of costs such as maintenance and taxes. Hence, investors in the UAE must always consider net ROI for a true profitability measure.

Investment Calculator UAE: Types and Applications

The following list highlights the most prominent types and applications of Investment Calculator in the UAE:

- Real Estate ROI Calculators: These instruments measure rental yield, appreciation, and ultimate returns of residential or commercial real estate investments in the UAE.

- Business ROI Calculators: Startups and SMEs in the UAE use these to estimate the profitability of marketing campaigns, expansion plans, or product development costs versus gains.

- Stock and Mutual Fund ROI Tools: Investors use these to calculate portfolio performance based on dividends, price changes, and holding duration within the UAE financial markets.

- Marketing ROI Calculators: These are mainly used by digital agencies located in the UAE to calculate the return on advertisement being spent by juxtaposing revenue created against the costs incurred toward running ad campaigns.

- Custom Investment Calculators: These allow UAE Investors to input many criteria including inflation, transaction fees, and timing to get ROI estimates tailored to complex investments.

Rental Yield and ROI Analysis in UAE

It is imperative to understand rental yield and ROI-making decisions in the UAE property market. Gross rental yield is calculated as the annual rent over property value, while ROI weighs in the entire costs against the net return. Popular areas like JVC or Business Bay tend to have rental yields of 6% to 9%. Looking at the two allows investors to know the complete income-generating ability and sustainability of property investments.

High ROI Areas in Dubai Real Estate

Certain areas in Dubai consistently offer high ROI because of demand, location, & rental price. Prominent locations among these are Dubai Marina, Jumeirah Village Circle (JVC), & International City; all of which tend to generate an ROI of more than 7%. These areas appeal to residents & investors due to affordability, availability of services, & good connectivity, thereby making them ideal areas to maximize real estate returns in Dubai.

Case Studies: Calculating ROI on UAE Properties

The real-world case studies show how investors in the UAE estimate ROI quite well. For example, selling price and rental income for property 1 could be purchased studio apartment in JVC for AED 400,000 and rented for AED 32,000 per annum, giving an ROI of 8%. Inclusion of service charge and possible vacancy will reduce net ROI further, but such case studies help prospective investors to estimate returns using realistic data.

Why Calculate ROI for Your UAE Investment

ROI is an important factor for placing an investment under the right judgment in the competitive environment of the UAE. Be it in the property, business, or startup, ROI gives you profitability, potential risk, and strategic planning. It makes sure that your capital is being channeled in the right avenue and gives you a measurable yardstick to compare all other options across the Emirates.

Common Mistakes in ROI Calculations

Here is a list of common mistakes in ROI calculations:

- Ignoring Hidden Costs: Many investors don’t consider costs for maintenance, insurance, or any service fees in their calculations of ROI, which leads to an overstated profit margin in real estate in the UAE.

- Overestimating Rental Income: The ROI may be inflated with the rental income expectations that are unrealistic in high-demand areas like Downtown Dubai, giving way to actual returns that are disappointing.

- Ignoring Vacancy Periods: The periods when a property lies vacant, if ignored, can go a long way in distorting the results of ROI, especially in a market that ebbs and flows through the UAE.

- Using Gross Instead of Net ROI: Gross ROI misses out on key costs. If one seeks accurate results through UAE contexts, then only the net ROI gives the real profitability.

- Not Considering Capital Gains Tax Implications: While at present there is no capital gains tax in the UAE, this is subject to change and can impact ROI. Long-term investors should shortly put plans in place for such policy changes.

Questions & Answers

ROI is calculated using the formula: ROI = (Net Profit ÷ Investment Cost) × 100.

A 40% ROI means that your investment generated a return 40% higher than its original cost. If you invest AED 10,000, a 40% ROI means a profit of AED 4,000.

To calculate a 7% ROI, multiply your investment amount by 0.07.

A 30% ROI means that your investment generated a return 30% higher than the original amount.