Recurring Deposit Calculator UAE – Estimate Returns Instantly

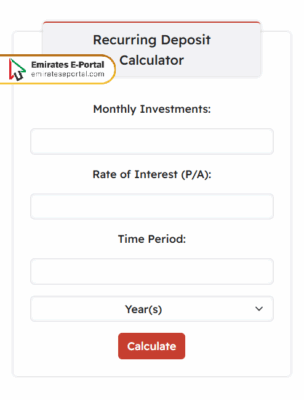

The following calculator can be used to easily perform recurring deposit calculations:

| Result Type | Value |

|---|---|

| Invested amount | 0 |

| Estimated returns | 0 |

| Total Value | 0 |

What is a Recurring Deposit and How it Works in the UAE

A recurring deposit is a kind of saving instrument where customers deposit fixed sums in the bank each month unto a pre-agreed period. It is a secure way of depositing while the depositor earns interest. When the account matures, the deposits made and the accrued interest are paid out. It is suitable for disciplined savers who expect their money to grow at fixed rates.

Step-by-Step Guide to Using a Recurring Deposit Calculator

To use recurring deposit calculator, Here’s how you can do it:

- Enter the value of Monthly Investments in the top field.

- Enter the Rate of Interest and then select the Time Period.

- Click on the Calculate icon after verifying the data.

- Check all details of the Recurring Deposit.

Benefits of Using a Recurring Deposit Calculator

Here are several benefits of using a recurring deposit calculator:

- Accurate Future Value Estimations: An accurate projection of your maturity amount is given by the calculator, depending upon deposit amount, tenure, and rate of interest. This helps you to effectively plan for certain financial goals.

- Time-saving Tool: The calculator instantly provides results and saves your time, whereas manual calculations could be prone to errors and add more stress to the financial planning process.

- Customizable Planning: The calculator allows you to explore monthly contributions under diverse tenures, giving an opportunity to adjust your saving pattern for either short or long-term goals expectations.

- Better Bank Offers Comparison: An input of specific rates of interest of different banks would be useful for comparing the earnings potential they offer in the UAE, thus choosing the best rewarding deposit plan.

- Enhanced Financial Discipline: Be it the monthly amount deposit or the earning from your investment, it helps you to keep to monthly saving and strengthens your habit of long-term financial discipline.

Factors Affecting Recurring Deposit Returns in the UAE

The following points highlight the main factors affecting recurring deposit returns in the UAE:

- Monthly Deposit Amount: The total returns are directly affected by how much you deposit each month. Higher monthly amounts naturally result in greater interest earnings & a higher maturity amount.

- Interest Rate Offered by the Bank: Different banks provide different interest rates based on tenure & customer profile. A small change in rate can significantly impact your total returns over time.

- Deposit Tenure: The length of your RD impacts compound interest growth. Longer tenures generally offer higher effective returns due to more interest compounding periods.

- Compounding Frequency: Interest may be compounded monthly, quarterly, or yearly. More frequent compounding means increased maturation amounts, where interest is paid on earlier interest.

- Early Withdrawal Penalties: If you withdraw early, penalties or reduced interest rates can apply. This significantly impacts final payout & reduces overall return potential.

Comparing Recurring Deposit Rates Among UAE Banks

Recurring deposit rates of interest are different amongst UAE banks, depending upon the tenure, amount deposited, and policies of the bank. Some banks offer higher interest rates if deposits are held for longer terms or for loyal customers. Comparison of these rates and method of compound interest should be done to ascertain maximum return. Always check beforehand whether interest rate is fixed or variable and whether this agrees with your paying needs and time frame.

Tax Implications on Recurring Deposit Interest in the UAE

With no income tax being levied in the UAE, the accrued interest on recurring deposits is exempted from any taxes for residents. However, expatriates should check with their home country to determine if it taxes global income. While locally tax deductions will not be made, it will be in their interest to keep all documentation on the interest earned for overseas reporting requirements so as to avoid complications later for both legal and financial reasons.

Early Withdrawal Rules and Penalties for Recurring Deposits

Early withdrawal on recurring deposits in the UAE attracts some penalties, in most cases. In fact, the bank may charge a lesser rate of interest or even levy a withdrawal fee, depending upon when such an amount is drawn. Some banks might give an option for partial withdrawal but with decreased privileges. It is always advisable to go through the terms of the bank so as not to be caught unaware on prematurely breaking an RD.

How to Plan Your Savings with Recurring Deposits

The following guidelines will help you plan your savings using recurring deposits:

- Set Clear Financial Goals: Saving for education, travel or a safety net—These objectives should be specific. Goals have a direct bearing on the amount of money to be deposited every month and the time period for which it needs to be deposited.

- Decide on the Correct Tenor: Choose an RD tenure in line with your goal timeline. When short-term however, short tenure RDs can be more suitable, while long-term goals gain better compounded returns.

- Use RD Calculators for Prediction: Use RD calculators timely at regular intervals with different monthly savings and interest rates to view how fast can the goals be realized.

- Check for Bank Promotions: Sometimes, banks offer promotional rates on RDs. Make use of these offers, so they can increase your returns without hike in your monthly deposits.

- Regularly Review and Change if Needed: Keep on checking your progress towards the savings aim and if it is found necessary, increase or decrease your monthly installments or change the staying period of RD. Responding to life changes and financial priorities may require flexibility in planning.

Tips to Maximize Your Returns on Recurring Deposits

Here are several tips to increase your returns on recurring deposits:

- Selecting Banks Offering High Interest: Rates differ and have to be compared among the various banks in the UAE. Even a small variation in interest rate could eventually yield better returns for you.

- Choose Longer Tenure Whenever Possible: If liquidity is not required soon, go for a longer deposit period. This leads to greater compounding and normally higher overall returns.

- Avoid Early Withdrawal: Withdrawals before maturity usually attract penalties or involve the forfeiture of interest. Stick to your plan and enjoy the full benefits accruing from your fixed deposit.

- Time Your Seat Plan with Deposits: If you deposit money from the very start of the month, compounds interest over the whole RD period will be maximized.

- If You Are Lazily Forgetting to Deposit Some Months, Set up an Auto-Debit: The auto-debit feature can help you with automatic monthly payments from your bank to the RD account and thus keep your RD plan going without missing a contribution.

Questions & Answers

Start calculating a RD in the UAE by multiplying the monthly installment by the number of months and then add the interest, which is calculated as per the bank's formula. The interest rates vary per different banks and depending upon the duration of deposits.

Recurring Deposits (RD) are more suited for regular savers who have a fixed monthly income, while Fixed Deposits (FD) suit a person with a lump sum. Generally, the FD returns are higher owing to the very fact that the amount is invested upfront and hence enjoyed by longer period of compounding.