Markup Calculator UAE 2026 – Calculate Profit Margins Easily

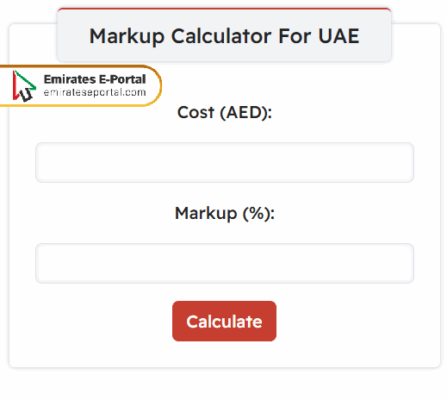

To calculate Markup in the UAE, you can use the following calculator:

Result:

| Metric | Value |

|---|---|

| Margin (AED) | |

| Revenue (AED) | |

| Profit (AED) |

What is a Markup Calculator

A markup calculator is a tool that businesses use to assign the selling price to an item, given its cost and profit margin percentage. A very popular practice in the UAE for marketers to simplify their pricing methods and maintain steady profits over time. It takes away the guessing from markup, applied in the most suitable manner to fit into the marketing needs of each retailer or service provider.

Guide to Calculating Markup for Your Business

Working out the price starts by figuring out the cost of the item. The next step is assigning the percentage for profit. Suppose we take the formula Selling Price = Cost + (Cost × Markup%). Put in these values into a markup calculator, and you get the price to be set. Taking the example given-an item priced at AED 100 will result in AED 125 after a 25% markup. This process can be repeated for each product line.

How to Use Markup Calculator in UAE

To use markup calculator in the UAE, Here’s how to do it:

- Write Cost in the designated field in UAE Durhams.

- Enter the Markup percentage in the field provided.

- Click on the calculate icon to see the details.

Benefits of Using Online Markup Calculators for UAE Businesses

The following points highlight the benefits of using online profit margin calculators for businesses in the UAE:

- Pricing Accuracy: Online markup calculators reduce the chance for human error by automating the more complex pricing formula applications. This is great for businesses in the UAE, where it is imperative that they set pricing accurately on a consistent basis so as not to develop customer mistrust and hence losing reliable profit margins.

- Saving Time: By automating the markup calculations, these tools save much time for businesspeople in the UAE. These tools remove repetitive tasks, thus allowing business persons to concentrate on business growth, customer service, and strategic planning rather than manual computations.

- Adaptability to VAT: Many of these online calculators are capable of handling VAT scenarios, which are an essential component of the tax landscape in the UAE. The arrangement prices the product and guarantees VAT compliance, thus reducing the risk of regulatory headaches.

- Improved Financial Planning: Such tools provide insights into profit margins and cost structures in a pragmatic fashion. Using these data, businesses in the UAE could take a better look at refining sales targets, inventory purchasing, and future pricing strategies based on actual markup performances.

- Improved Competitiveness: Having the instant pricing analysis keeps the businesses competitive in the ever-rolling market in the UAE. This will allow them to set rates to lure customers while keeping afloat at the same time with utmost profitability in retail and wholesale sectors.

Impact of VAT on Markup Calculations in UAE

Pakistan’s VAT system at 5% dictates crucial considerations for pricing strategies. When doing so with markup calculators, one should consider VAT either being included into the price before adding the markup or after it. Wrong placement of VAT will result either in the wrong price or eroding margins. Correct placement of VAT ensures compliance and gives profit realization to various sectors.

Using Markup Calculators for Retail vs. Wholesale Pricing

The markup schemes also differ in the retail and the wholesale models in the UAE. Retailers impose higher markups because of both overhead costs and the needs of customer service costs, while wholesalers go for lower margins with higher volume. A markup calculator will a allow both models to correctly price their products with regard to their cost set-up, their target market and their position in a competitive ring so as to provide a sustainable business.

Understanding the Difference Between Markup and Margin

The following points help in understanding the difference between Markup and margin:

- Pricing Impact: Use of margin instead of markup (or the other way round) can substantially alter the final selling price. UAE businesses should, thus, understand both, so they can use the appropriate one as per the industry standard.

- Reports and Analysis: Financial reports are made with margin, whereas operational teams use markup. UAE-based companies need to internally communicate so that both teams understand the pricing data alike, so as to avoid any confusion during strategic planning.

- Customer Perception: Pricing decisions made with the influence of either margin or markup can affect customer perception for value. UAE businesses would want to be clear on this, so they can price fairly while being protective of their profit margins.

- Tool Compatibility: Some UAE-centric tools, by default, use either margin or markup. Hence, being aware of the differences would assist in using the kind of software or calculator needed in working for local businesses.

How Markup Affects Pricing Strategies in UAE Markets

The following points illustrate how profit margin affects pricing strategies in UAE markets:

- Direct Influence on Profitability: The higher the markup, the higher the profit from every unit sold. UAE companies must take a careful look at markup according to the market demand and competitor pricing, so it can remain profitable with the loss of customers.

- Positioning of the Market: A business generally uses markup to price its products to be accepted by the market as premium or budget. A varied market such as UAE needs accurate markup for its product positioning for both local and expat consumers.

- Sector-Specific Adjustments: Different sectors have different ranges of acceptability for markups; this accounts for fashion, electronics, and food. Understanding this allows UAE companies to create strategies that are in accordance with expectations of the sector and consumer pattern.

- Response to Economic Trends: The markups are controlled by profit during periods of inflation and supply chain disruptions. The companies in the UAE rather need pricing models easily adjustable to cushion the present economic discrepancies limiting sales.

- Promotion Planning: Knowing your markup helps in the calculation of how much discount can be offered to the customers from selling prices during promotion for sales without going into loss. This holds huge prominence for UAE companies when offering promotions during Ramadan, Eid, or DSF.

How to Adjust Markup Based on Industry Standards in UAE

In the UAE, different industries may exhibit dissimilar degrees of markups, depending on their norm maturity levels. For instance, the prices in electronics tend to be kept much lower than what fashions or cosmetics can afford to charge their clients. Businesses, therefore, must research industry standards and customer expectations before setting their prices. Since this is not fixed, rather flexible, a markup calculator will assist in making amendments.

Common Mistakes to Avoid When Using a Markup Calculator

Here are several common mistakes to avoid when using a profit margin calculator:

- Using Selling Price Instead of Cost: Some operators enter selling prices rather than their costs, thus reporting very wrong markup values. For UAE businesses, care must be taken to use the right base for the correct computation of markup.

- Ignoring VAT: Most omit VAT from their computations of the markup, producing pricing inconsistencies. On the other hand, VAT must be properly accounted for by UAE companies to meet their tax liabilities and net profit targets.

- Having a Uniform Markup Across: Considering markup across all products disregards the costing and market demand for a particular product. Retailers in the UAE should practice graduated markups on the basis of product categories and customer behavior.

- Not Updating Cost Input: Old data can sabotage pricing accuracy. To provide current pricing based on factors in the market and input suppliers, UAE businesses must keep updating costs in the calculator.

- Ignoring Industry Benchmarks: Ignoring normal markup rates in your industry would make your price non-competitive. Accordingly, for such etiquette standards, UAE companies ought to look into industry norms prior to fixing markup percentages.