Jafza Gratuity Calculator UAE 2026 – End of Service Calculation

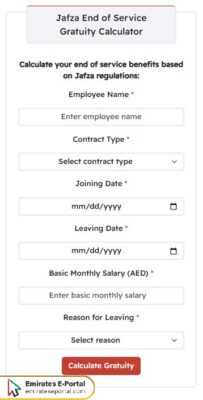

To calculate Jafza Gratuity in the UAE, you can use the following calculator:

Jafza Gratuity Calculation Results

Understanding Gratuity Entitlements for Jafza Employees

Gratuity for Jafza employees is a lump sum payment given under the Labor Laws of the UAE according to years of service. A registered employee is entitled to 21 days’ basic pay per year for the first five years and 30 days after that. These payments are considered on termination of a contract, or lawful termination, and the employee has served the minimum of one year.

Step-by-Step Guide to Calculating Gratuity in Jafza

To use Jafza Gratuity Calculator online, Just follow these easy steps:

- Write the Employee Name in the designated field.

- Select Contract Type from the drop-down list.

- Enter the start and end dates of work using the calendar.

- Enter your Basic Monthly Salary and then choose the reason for leaving your job.

- Click on the Calculate icon to view the value of the end-of-service bonus.

Key Factors Influencing Gratuity Calculations in Jafza

The following list shows key factors influencing gratuity calculations in Jafza:

- Length of Continuous Service: The years of uninterrupted service are directly related to gratuity amount. Employees with more than five years are entitled to a greater value, while with lesser service they are entitled to less or none for service below one year.

- Type of contract: The kind of contract, limited or unlimited, greatly affects the gratuity scheme. Limited contracts mostly witness full gratuity being granted after completion, whereas for unlimited contracts, gratuity may be reduced when resignation is early.

- Basic salary at seniority: It is eligible for gratuity calculation only based on the last basic salary of the employee after service termination. A greater basic salary in the final separation contributes toward increasing the gratuity amount.

- Cause for leaving the job: An employee will miss his gratuity if found guilty of resigning or firing himself-under Article 120. All unjustified terminations would thus accept full payment corresponding to time spent.

- Unauthorized Absence or Misconduct: According to these discriminatory actions or absences, rights to the gratuity can be jeopardized, especially if dismissal is carried out on the basis of legal provisions that preclude granting of benefits.

- Errors in Calculation or Policy Variations: Internal HR policies or the misapplication of the law can affect the expected amounts. Jafza companies may interpret the rules differently or implement the rules differently, affecting the final numbers.

Differences Between Limited and Unlimited Contracts in Gratuity Computation

The kind of contract, whether limited or unlimited, affects what is calculated as gratuity. If an employee worked within the ambit of a limited contract, the full gratuity is usually granted if the contract has been completed. Employees under an unlimited contract tend to lose gratuity in case of resignation, unless that person was employed for more years. Conversely, termination without cause tends to ensure full gratuity while resigning early under unlimited contracts could result in partial or complete denial of gratuity.

Impact of Resignation and Termination on Gratuity Eligibility

Gratuity entitlement depends on the manner in which employment comes to an end. Termination at the hands of the employer ordinarily entitles the worker to full benefits. On the other hand, in the case of employee resignation, gratuity might be lessened, chiefly when the period of service is less than five years. For resignations under unrestricted contracts, the entitled gratuity might be as low as one-third of the full fare.

Legal Caps and Maximum Limits on Gratuity Payments in Jafza

While gratuity is calculated according to the number of years worked and the employee’s basic salary, there are legal restrictions imposed by the UAE regarding the amount. The maximum gratuity amount is not to exceed two years’ gross salary. Gratuity forfeiture can also result if there is some violation or breach under Article 120 of the Labour Law. Apart from this, Jafza employees should factor in any company policy that further limits gratuity.

Common Mistakes to Avoid When Calculating Gratuity

Below is a list of common mistakes to avoid when calculating gratuity:

- Including Non-Basic Salary Components: Many mistakenly include allowances, commissions, or bonuses in gratuity calculations. UAE law states that only the basic salary should be considered, thereby producing a more accurate and lawful outcome.

- Ignoring Contract Type Differences: Overlooking whether the employment contract is limited or unlimited can lead to incorrect assumptions about entitlements, especially in cases of resignation or early termination.

- Misunderstanding Resignation Rules: Those who resign of course are supposed to be aware of the possibility of reduced gratuity rates when resigning under unlimited contracts before actually completing five years. Instead, many of them seem to just inflate their expectations for the final payout.

- Neglecting Minimum Service Period: Calculating gratuity while disregarding the criteria of a minimum period of one year in service is one of the very common mistakes to be made in respect of gratuity, because any person whose length of service is below years is not entitled to it.

- Using Outdated Calculators: Gratuity calculators that have not been updated with the recent amendments to the UAE Labor Law might mislead the affected persons, especially when the laws have undergone changes affecting gratuity caps or gratuity calculations.

- Not Considering Legal Deductions: Since legal deductions or penalties on account of wrongdoing are disregarded, unreal gratuity projections arise, particularly if the employee was dismissed on disciplinary grounds.

- Assuming Polices Are The Same Within Companies: It is far from the truth to believe that all Jafza companies calculate gratuity the same way. Somehow, company policies and interpretations may interfere with entitlements under UAE law.

Questions & Answers

Yes, the Jafza Gratuity calculation varies based on length of service, and the calculation method becomes different after the first 5 years.

The Jafza Gratuity calculation in the UAE is based on 21 working days for each year of the first 5 years and then 30 working days for each year thereafter.

Yes, the Jafza Gratuity calculation is subject to the applicable UAE Labor Law.