Fixed Deposit Calculator UAE – Estimate Your Returns Easily 2026

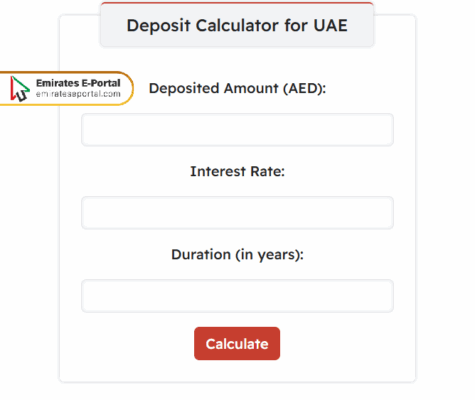

To calculate fixed deposits in the UAE, you can use the following calculator:

Your Fixed Deposit Details

| Parameter | Value |

|---|---|

| Deposit Amount (AED) | – |

| Interest Rate | – |

| Duration | – |

| Total Interest Earned | – |

| Total Deposit Amount (AED) | – |

Understanding Fixed Deposits in the UAE

Fixed deposits in the UAE have a very low risk occurring when an investor allocates a fixed amount for a predetermined period. The banks guarantee interest returns over the period, which makes it a choice for fairly conservative investors. During the term, your money remains untouchable; if it is withdrawn in advance, penalties follow. This inculcates disciplined savings and ensures predictable earnings.

How to Use a Fixed Deposit Calculator Effectively

To use a fixed deposit calculator effectively, Here’s what you need to do:

- Write Deposited Amount in UAE Durhams.

- Enter the Interest Rate in the designated field.

- Write the duration and then click on the calculate icon.

Comparing Fixed Deposit Interest Rates Across UAE Banks

Interest rates on fixed deposits vary among UAE banks depending on the tenure, deposit amount, and currency. Some banks would provide special rates for new customers or for higher deposits. Rates must be compared to choose the best one maximizing returns while also considering reputation, terms, and conditions of early withdrawal of a banker.

Factors Influencing Fixed Deposit Returns in the UAE

The following list highlights the most important factors affecting fixed deposit returns in the UAE:

- Interest Rate Fluctuations: The bank interest rates range as per central bank policies and market trends, directly affecting the return for the fixed deposit in the said period of investment.

- Tenure: Interest earnings are influenced by deposit tenure, and longer periods usually pay increased interest charges, while they also decrease liquidity and access to acceptance of funds until maturity.

- Minimum Deposit Amount: The minimum size of fixed deposit may influence the return on the investment considering that banks may offer better interest rates for bigger fixed deposit amounts.

- Inflationary Effect: Inflation depletes the real worth of interest accrued; thus, high inflation rates reduce the worthiness of returns from the fixed deposits.

- Early Withdrawal Charges: These charges diminish the effective returns, and hence, it becomes important that the investor must understand the complete withdrawal terms before taking any investment decision.

Benefits of Investing in Fixed Deposits

Here are several benefits of investing in fixed deposits:

- Assured Returns: Fixed deposits pay out assured returns, providing a steady predictable income, one that is independent of market fluctuations.

- Protection of Capital: Fixed deposits protect the initial investment amount and therefore have a low risk for investors putting safety above higher returns.

- Flexible Tenure Options: Investors may select from several tenure periods and adapt investments to their current financial plans or liquidity requirements.

- Online Management: This permits any fixed deposit to be opened, tracked, and renewed by a client from home without having to visit any branch physically.

- Diversification of Portfolio: With the fixed deposit that acts as an income-sharing source for the more risky investments, one can go on investing in diversification for better risk management of the portfolio.

Early Withdrawal Rules and Penalties for Fixed Deposits

Most UAE banks impose penalty charges for withdrawals before maturity of fixed deposits. These may be in the nature of disproportionate interest payout or complete forfeiture of the interest earned. It all depends on how premature the withdrawal is. In some cases, the banks may set a minimum lock-in period before a premature termination of fixed deposits is allowed.

Tax Implications on Fixed Deposit Interest in the UAE

The UAE currently does not impose income tax on interest on fixed deposits for individuals. Hence, fixed deposits are one of the most preferred savings vehicles available. However, a resident with tax obligations abroad may have to declare income from interest. There may be bilateral treaties that need to be considered which might affect the reporting or taxation obligations.

Tips to Maximize Returns on Fixed Deposits

Here are tips to maximize your fixed deposit returns:

- Compare Interest Rates: Always check with multiple banks to get the best interest rate so that your fixed deposit gives you maximum returns.

- Choose Longer Tenures: Long-term deposits usually bring in more interest rates and thus significantly boost total returns, given that there’s no urgent requirement for the funds.

- Ladder Your Deposits: Splitting an investment amount into several fixed deposits with staggered maturities increases liquidity and maximizes returns as the interest rates change.

- Reinvest the Matured Deposits: Compounding accelerates the growth of your savings as you keep rolling over your matured fixed deposits.

- Ask For Special Bonus Rates: Banks will from time to time offer special promotion rates or bonuses; use them at the bank for your benefit.

Common Mistakes to Avoid When Investing in Fixed Deposits

The following list includes common mistakes to avoid when investing in fixed deposits:

- Ignoring Early Withdrawal Terms: Not being conscious of early withdrawal penalties can create the impression of charges and the loss of principal or interest on the funds disbursed prior to maturity.

- Forgetting Inflation: Ignorance about inflation leads to the over projection of real returns as inflation diminishes the purchasing power of interest earned.

- Lack of Diversification: Committing all funds to a single fixed deposit restricts any financial coping mechanism and exposes the investor to downside if the rate drops or there arises an immediate liquidity need.

- Not Comparing Bank Rates: Taking the rate offered at the first bank might fail to make the earnings most favorable as every bank quotes different fixed deposit rates.

- Ignoring Taxation: Ignoring the incidence of tax on the interest income could reduce net returns, especially where withholding tax applies in some jurisdictions or where the government imposes some levies.

Questions & Answers

A fixed deposit in the UAE is a financial product wherein you deposit a lump sum with a bank for a fixed period, earning a guaranteed interest at a stipulated rate generally higher than the interest rates offered on savings accounts.

Fixed deposit interest is calculated on the basis of the principal amount, interest rate, & actual period of acceptance of the deposit. Depending on the agreement, banks apply simple or compound interest formula, & the crediting of interest can be monthly, quarterly, or on maturity.

The possible risks are low liquidity as your funds are locked for a fixed term, means penalties for early withdrawal, & an inflation risk, thus reducing your real return. Another risk includes that interest rates may actually be lower than potential returns from a variety of other investments.