Debt Burden Ratio Calculator for UAE 2026

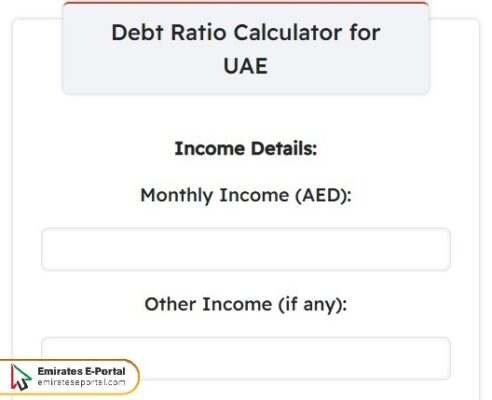

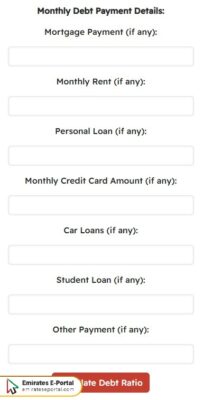

To calculate your Debt Burden Ratio you can use the following calculator:

What Is the Debt Burden Ratio and Why it Matters in the UAE

The Debt Burden Ratio (DBR) is mainly the percentage of one’s monthly income that is put to settle debts. In the UAE, it is one of the prominent factors determining whether you can give credit or obligations. A lower DBR score indicates a healthy financial standing; hence, getting credit or a loan from any bank or financial institution might prove easy with it.

How to Use Online Debt Burden Ratio Calculator

To use online Debt Burden Ratio calculator, Here’s what you need to do:

- Add Income Details data in the designated fields.

- Enter all Monthly Debt Payment Details.

- Verify the accuracy of all data.

- Click on the Calculate Debt Ratio icon.

- Check all the details displayed by the calculator carefully.

Online Debt Burden Ratio Calculators: Features and Accuracy

Here are several features of online debt burden ratio calculators:

- User-Friendly Interface: Most of the online DBR calculators in the UAE are designed with a simple interface in which users can enter income, existing debts, and credit card limits without facing complexity, making it accessible for even a new user.

- Real-Time Calculation: This calculator renders an instant result upon entering data, allowing the user to immediately comprehend the financial standing and take quick decisions without having to crunch numbers on their own.

- Accuracy Depends on Input Quality: The reliability of DBR calculators is contingent on the data being put in by the users. Inputting incorrect salary amounts or forgetting to factor in a certain debt would give a misleading result, thereby messing up the decision process.

- Custom Inputs for Loan Types: These calculators may further specify cash loan categories, such as personal loans or mortgages, for the purpose of more specific and realistic calculations for the monthly debt burden.

- Limitations in Complex Cases: These calculators might not consider all banks’ underwriting policies or situations such as joint income or obligations in two different currencies that could affect real-world accuracy.

UAE Central Bank Regulations on Debt Burden Ratio Limits

The laws of the UAE Central Bank state that debt repayments must not exceed 50% of an individual’s monthly income. This measure started as a way to protect consumers from excessive debt and ensure responsible lending. Financial institutions must abide by the rule while rating a person seeking a personal loan, car loan, or a credit card, to reduce cases of default to a bare minimum and keep economic stability intact.

Key Components Included in Debt Burden Ratio Calculations

Below is a list showing the key components involved in debt burden ratio calculations:

- Gross Monthly Salary: This is the net monthly income before deductions and forms the base of DBR calculations to represent how much financial load can be borne by an individual on the basis of stable earnings.

- All Active Loan Repayments: Any monthly installment for existing loans payable to car auto loans, personal loans, or home loans are counted against you as financial obligations and thus reduce your capacity to borrow.

- Minimum Credit Card Payments: This is when banks, regardless of whether you use a credit card or not, consider 5% of your card limit as a monthly commitment and impact your DBR percentage whatsoever.

- Housing Payments, When Applicable: In some cases, such as when processing mortgage applications, banks take into account rent or home loan payments that you currently make so that your overall housing cost burden is considered.

- Other Fixed Financial Obligations: Depending upon the lender’s policy, any recurring payments such as child support, alimony, or outstanding installments on financed goods may also be considered in DBR calculations.

Impact of Credit Card Limits on Your Debt Burden Ratio

The credit card limits in the UAE are counted in full toward your debt burden ratio irrespective of the amount utilized from this limit. Therefore, having a high unused limit goes against your DBR. Banks look at the potential liability, not just the existing balances; the more you have, the less you can borrow, making future loan applications much harder.

How Debt Burden Ratio Affects Loan and Credit Card Approvals

A high DBR is a red flag for loan or credit card application rejections in the UAE because it signals a financial overextension. Lenders see this just as a risk that payments will be missed. Most probably, to qualify for financing, you have to keep your DBR under 50%. Sticking to this rule makes it much easier for you to get approved, especially when you keep existing debts low and responsibly manage your credit facilities.

Tips to Lower Your Debt Burden Ratio Before Applying for Finance

The following list includes many tips to reduce your debt burden ratio before applying for financing:

- Settle Small Debts: Clearing of minor outstanding loans or credit card balances reduces monthly obligations; hence, a decrease in DBR would work in favor of new credit approval.

- Declare Additional Income: Other legitimate incomes than usual can be declared to give a larger income base, so a lower DBR percentage and a stronger loan application.

- Do Not Apply for New Credit: Keeping the DRB down by resisting new credit openings before the application prevents red flags for lenders.

- Loan Consolidation: A single loan for small loans with lower EMI reduces the number of places holding your debt and consequently lowers the burden measured in DBR.

- Cancel Unused Cards: These affect your DBR, so cancelling those with high limits will bring down the credit delinquency that factors into the DBR.

Common Mistakes to Avoid When Calculating Debt Burden Ratio

The following list outlines several common mistakes to avoid when calculating your debt burden ratio:

- Ignoring Credit Card Limits: A lot of folks leave out their credit card limits when calculating DBR, whereas banks usually consider some percentage of the total limit as a fixed liability.

- Using Net Income Instead of Gross: Since banks observe debt burden on gross income before any deduction or taxes, calculating DBR using net salary could lead to an inaccurate ratio.

- Missing Out on All Loan Obligations: If small EMIs or installment payments are missed, the DBR could be misleading and not really represent the true financial burden on a lender.

- Assuming All Banks Calculate DBR the Same Way: Some banks could use slightly different value formulas or considerations, so it would be misleading to rely on only one calculator.

- Not Updating Income or Loan Changes: Outdated figures, such as salary information before a raise or recent loans taken since the last DBR, can fool you by misrepresenting your real DBR and affecting your planning or rejected applications.

Questions & Answers

The DSR in the UAE is calculated based on the total income and loans availed by the citizen or resident.

A good DSR is considered to be below 50%, and the lower the ratio, the better.

The importance of calculating the DSR in the UAE lies in providing an understanding of the citizen or resident's ability to obtain further loans.