Commission Calculator UAE – Simple & Reliable Tool for 2026

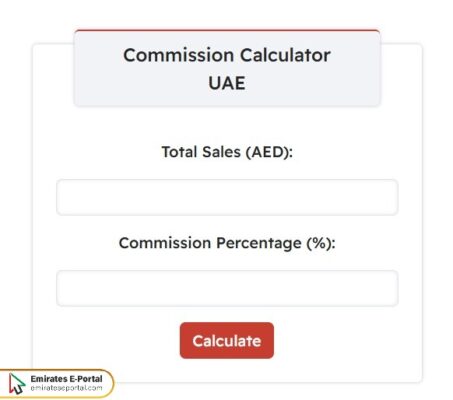

You can use the following calculator to easily calculate commissions in the UAE online:

Understanding Commission Calculators

The commission calculator provides an accurate estimate of the commission earned by salespeople for their total sales. Its importance lies in providing an accurate estimate that reduces the error rate typically associated with human calculations, ensuring that all salespeople receive their full dues.

How to Use Commission Calculator in the UAE

To use commission calculator in the UAE, Just follow these easy steps:

- Write Total Sales in UAE Dirhams.

- Enter the Commission Percentage in the field provided.

- Click on the calculate icon to see the result.

Key Inputs Required for Accurate Commission Calculations

Accurately calculating information doesn’t require providing a lot of data and information. You must provide the total sales value correctly and then verify the commission rate. If multiple sales are involved, you must accurately determine the value of each one and then add them together correctly to calculate the commission.

Example of Calculating Commission in the UAE

Suppose a real estate agent sells a property in Dubai for AED 1,500,000. The standard commission rate is 2% only. Here is how to calculate the commission value:

- Sale Price = AED 1,500,000

- Commission Rate = 2%

- Commission Amount = AED 1,500,000 × 0.02 = AED 30,000

Common Commission Structures Across UAE Industries

Through the following list you can find out Common Commission Structures across UAE Industries:

- Real Estate: Usually, agents are paid 2% of the sale price as commission, which is often borne by the buyer. Sometimes, buyer and seller make contributions, the exact arrangement being agency-dependent.

- Automotive Sales: Car salespersons are usually paid a fixed percentage of the price of each vehicle from 1% to 3%, with larger bonuses depending on reaching sales targets monthly or selling luxury vehicles.

- Retail and Fashion: Usually, commissions are given on a performance basis, with sales teams earning a percentage of the sales they make or achieve as a team. Rates change depending on brand, store type, and time of the year.

- Insurance and Finance: Insurance brokers and financial advisors will usually work on tiered commission structures, getting higher rates when placing long-term or high-value insurance contracts and investments.

- Recruitment Agencies: Such firms usually charge an employer kind of fee between 10 and 20% of the annual salary of the hired candidate. Also, internal recruiters may find themselves awarded bonus commission for every successful placement.

Benefits of Using Online Commission Calculators in the UAE

The following points highlight the benefits of using online commission calculators in the UAE:

- Time-saving and Instant Results: The commission calculators instantaneously calculate commissions, saving the users from doing manual calculations and permitting quick comparisons across different commission plans and client deals.

- Accuracy and Reduced Errors: Commission calculators provide calculations based on fixed formulas, limiting chances of errors, which is very helpful for agents or businesses with multiple commission structures at a time.

- Better Financial Planning: The user is able to test different scenarios with the help of such a tool to forecast earnings. As a result, it aids in setting realistic monthly or quarterly sales targets and streamlining the management of personal or business finances.

- Transparency in Earnings: These calculators promote transparency in income between employer and employee and client and agent to ensure clarity on which commission is due.

- Accessible Anytime, Anywhere: Being mobile-friendly, they are available around the clock, so professionals have the ease of calculating their earnings on the road, mostly in hurriedly moving industries like real estate or retail.

Avoiding Common Mistakes in Commission Calculations

The following points can help you avoid common mistakes in commission calculations:

- Ignoring Hidden Deductions: Much neglect administrative or tax deductions affecting the net commission. All relevant fees should be included to avoid over-crediting the final payout.

- Using Incorrect Rates: Wrong, old commission percentages are often applied in error. It is always good to look over contract terms or employer policies prior to calculating any commission.

- Miscalculating Gross vs. Net Sales: Gross sales are billed before returns or discounts, erroneously raising commission expectations. To be correct, net sales are considered after all revenue adjustments.

- Ignoring Commission Caps: In some places, the maximum commission is set by the employer or industry. If not accounted for, it would bring disappointment or inaccurate financial planning.

- Not Updating for Tiered Structures: Tiered commission structures undergo alterations once performance thresholds are met. Failure to update the calculator to these levels could lead to ill representation of the commission received.

Comparing Commission Rates Across Different UAE Sectors

Commission rates in the UAE vary significantly by industry. Real estate agents typically earn around 2% of the property value, while insurance brokers may receive up to 10% of policy premiums. Sales professionals in retail often work on smaller percentages, typically 1%–3%. These differences highlight the importance of understanding sector-specific structures when evaluating commission-based roles.

Tips for Negotiating Better Commission Rates

Here are some tips for negotiating better commission rates:

- Showcase Proven Sales Results: Demonstrate your worth through prior performance statistics. A proven track record in generating revenue is a powerful argument that can help you demand higher commission rates.

- Know Industry Norms: Investigate what competitors provide in comparable job descriptions. This insight lends weight to your negotiations and validates that your demand is fair and competitive.

- Suggest Tiered Incentives: Ask for commissions that increase with sales volume; more sales, more commission. This form of compensation aligns your successes with those of the employer and speaks to a commitment from you for the long term.

- Leverage Multiple Offers: Consider politely bringing offers for other jobs or projects that promise better commission terms to the negotiating table. This can open up the possibility of a counteroffer or an improved structure.

- Negotiate at the Right Time: Ideally, commission discussions occur when negotiating an initial contract that follows consistent results or in contract renewal. Your timing will go a very long way in determining the outcome.

Questions & Answers

Commission in the UAE is calculated by multiplying the total amount by the commission percentage.

Commission is not taxable in the UAE.

There is no doubt that commission is legal in the UAE, subject to the relevant laws and regulations.