Inflation Calculator UAE – Measure Dirham Value Over the Years

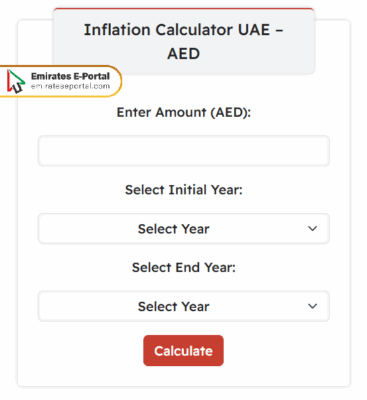

To calculate inflation in the UAE, you can use the following calculator:

What is an Inflation Calculator & How Does it Work

An inflation calculator is an inflation-watching tool that calculates how much purchasing ability changes over time. Such an application in the UAE is particularly useful in terms of considering long-term financial trends and hence adjusting personal/business budgets to plan accurately into the future.

How to Use the Inflation Calculator for Accurate Insights

To use the inflation calculator for accurate insights, Here’s how you can do it:

- Enter the amount in the field provided in AED.

- Select Initial Year from the drop-down list.

- Use the drop-down list to select an End Year.

- Click on the calculate icon to see the details.

Why UAE Residents Should Monitor Inflation Trends

The following points explain Why UAE Residents should monitor inflation trends:

- Budgeting Awareness: When inflation is monitored, residents get to witness the rise in prices of common goods. This enables them to adjust their budgets monthly and prevent sudden events in paying out living expenses such as rent, fuel, groceries, among others.

- Preparedness for Price Increases: Inflation updates allow individuals to stay ahead of practice hikes with regard to purchases or purchases and make timely decisions about spending, saving, or investing to maintain their financial security.

- Understanding Policy Changes: Inflation figures influence the policies related to subsidies or wage changes by the Government. When residents understand the trends, they can prepare for how these policies will impact their bottom line.

- Real vs. Nominal Income: Residents can understand whether there is real income growth or whether they are only being given an illusion through inflation by monitoring inflation, so they can factor in their changes accurately.

- Informed Major Decisions: One can plan on big expenditures or commitments such as purchasing property or taking loans with the knowledge of inflation trends, especially in an ever-changing economy such as that of the UAE.

Why Does Inflation in UAE Change from Time to Time

Inflation in the UAE changes according to various factors such as cheap or high global oil prices, import taxes, supply chain disruptions, various government subsidies, and different trends of the housing market. Seasonal demand, state of the international economy, and shifts in consumer behavior also affect the inflation rates. Volatile monetary policies and currency exchange rates mold their inflationary effects too, which then determine the movement of inflation for some particular time depending upon the economic pressure of variables.

Understanding the Impact of Inflation on Purchasing Power in the UAE

The following list helps you understand the impact of inflation on purchasing power in the UAE:

- Eroding Value of Money: Inflation decreases the Durham’s real value, meaning people would be able to acquire less with the same amount of money, and thus living standards would decline unless income increases accordingly.

- Savings Devaluation: When inflation goes up, money saved in a low-interest account becomes worthless with time, underscoring the need to invest in savings or high-return avenues that keep pace with inflation.

- Mismatch in Salary Growth: Even if there may be an increase in wages year after year, it is all but sure those increment levels can never catch up to inflation as a result of which an employee will face too much difficulty in meeting the basic costs or to save any money.

- Sector-Specific Inflation Impact: Inflation could hit different sectors differently, in that costs of housing, fuel, education, and health care usually grow at rates higher than inflation, thereby squeezing residents on fixed incomes.

- Altering Consumer Behavior: Inflation tends to change consumer behavior as people begin to cut down on non-essential items in order to focus on purchasing essentials, affecting consumer budgets and the wider economy.

Comparing UAE Inflation Rates with Global Averages

Inflation rates in the UAE have yet remained more stable than in most developing countries pacing due to a strong currency backing and government subsidies. The prices, however, do get affected by global happenings in terms of shifts in oil prices or supply chain disruptions. An insight into the resilience of this economy and purchasing power stability over time is thus offered by holding a comparison of UAE inflation vis-a-vis the global averages.

The Role of Inflation in Financial Planning & Investment Strategies

The following points illustrate the role of inflation in financial planning and investment strategies:

- Future Value Estimation: Inflation should be taken into consideration when making financial planning estimations in terms of how much current savings or income will stand in value in the future, particularly with long-range goals such as retirement.

- Protecting Investment Returns: The return from investments has to exceed inflation for it to be referred to as a real return. In the disregard of inflation, a semblance of growth feels just enough, only to be eaten up by rising prices.

- Diversified Investment Needs: Inflation prompts diversification into assets such as real estate or gold that usually maintain their value better than cash or low-yielding savings during inflationary periods.

- Retirement Planning Accuracy: If inflation is not considered in retirement calculations, one might end up under-funding in later life. By forecasting future expenses more realistically, there is a higher guarantee of long-term security.

- Interest Rate Considerations: Inflation matters when central banks determine interest rates, thereby affecting loans and saving returns. Being aware of all this would lead people to better choices when borrowing and investing.

Common Mistakes to Avoid When Using Inflation Calculators

Here are several common mistakes to avoid when using inflation calculators:

- Wrong Timeframe: Using time ranges that do not match or are unrealistic results in inaccurate results. While entering data, always think of time periods relative to your financial goal or analysis.

- Assuming Inflation to Be Uniform: Many users mistakenly hold the view that inflation is uniform across spending areas. Inflation, however, fluctuates across sectors, and calculators may not always represent your particular expense categories.

- Ignoring the Compounding Effect: Inflation is a compound effect that prevails over time. Ignoring that diminishes our view on how much impact is made on the long term and can provide improper guidance in making financial decisions such as estimating savings or checking for retirement benefits.

- Using Non-Local Data: UAE residents sometimes use calculators from across the globe that do not consider the local CPI rates, thereby generating misleading output. Always choose those tools with UAE-specific data.

- Ignoring Life-Style Changes: Many users do not change their inputs to account for life changes, such as marriage, relocation, and the additional requirements of a dependent. The result is formulating projections that do not actually reflect true costs in the future.

Real-Life Examples: Inflation’s Effect on Daily Expenses in the UAE

Finally, is that in the case of inflation, a basket of grocery with AED 200 worth five years ago could likely become AED 230 due to increases in food and utility prices. Other prices that have gone up somewhat have also been rent, school fees, and healthcare. Prices that table moderate yearly increases build up over time and significantly affect household budgeting and long-term financial planning in the UAE.

Questions & Answers

As of April 2025, the UAE's inflation rate was 2.31, which is down from the previous month. Inflation continues to fluctuate depending on several factors.

You can calculate the inflation rate by subtracting the previous CPI from the subsequent CPI, then dividing the result by the subsequent CPI, and multiplying the final result by 100 to get the percentage.

To calculate the inflation-adjusted price, you must multiply the original price by the ratio of the current CPI to the previous CPI.