EMI Calculator UAE: Fast Online Tool for All Loan Types

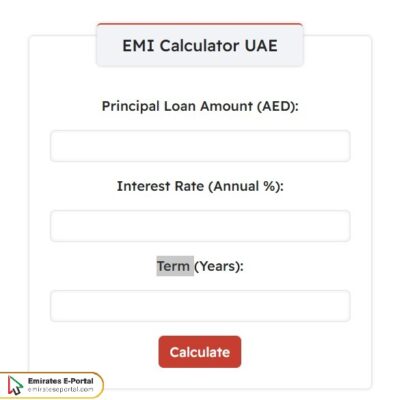

With the following calculator, you can easily calculate all EMI details online:

Monthly EMI (AED):

Total Payment (AED):

Total Interest (AED):

Yearly Repayment Schedule (AED)

| Year | Principal | Interest Paid | Principal Paid | Balance Amount | Loan Amount Paid (%) |

|---|

What is an EMI Calculator and How Does it Work?

The EMI calculator aims to help all borrowers in the UAE determine the monthly installments they will pay based on their loan information. It works by entering the principal amount of the loan, the profit or interest rate, and the number of years. The calculator then performs the required calculations and provides the results immediately.

Key Inputs Required for EMI Calculation

The following list shows the basic inputs in the EMI calculator:

- Principal Loan Amount: Principal Loan Amount refers to the amount the borrower is obtaining to finance the purchase of a car, apartment, or other property. It must be entered in the local currency and accurately for the calculator to provide accurate results.

- Interest Rate: The interest rate is entered as a percentage for each year, because financial institutions typically repeat it once each year during the loan term and then add it to the original amount borrowed to calculate the total amount.

- Term: When using the calculator, you must enter the loan term in years. The calculator will calculate the number of months and everything related to the term to provide an accurate result regarding the loan amount.

How to Use an EMI Calculator for Financial Planning

To use an EMI calculator for financial planning, Here’s how you can do it:

- Type the Principal Amount in the field provided.

- Enter the interest rate for the loan.

- Write the duration in years and then click Calculate.

- Check EMI details.

Example of Calculating Loan EMI in the UAE

Let’s assume you are applying for a personal loan of AED 100,000 in the UAE, with an interest rate of 5.5% per annum and a tenure of 3 years. Here’s how to calculate this loan:

- Loan Amount = AED 100,000

- Annual Interest Rate = 5.5%

- Term = 3 years = 36 months

- Monthly EMI = AED 3,019.59

- Total Payment = AED 108,705.25

- Total Interest = AED 8,705.25

Comparing Loan Offers Using EMI Calculators

The EMI calculator helps you compare loans by showing you::

- Interest Rate Differences: These EMI calculators help you analyze how different interest rates affect the monthly payment and total interest cost over time, therefore identifying the most cost-effective arrangement based on your budget and capacity for repayment.

- Effects of Tenure: Entering the same amount of loan with different tenures shows clearly how longer terms lower EMI but increase total interest paid so that you could find the right balance between monthly affordability and overall cost.

- Bank-Specific Offerings: Different banks in the UAE have different charges, interest structures, and repayment options. The EMI calculators permit users to enter details of such scenarios, juxtaposed, to select the real value.

- Total Cost Comparison: Apart from just showing the EMI amount, the calculator also shows the total amount to be repaid, which will be of real help in weighing the real burden of the loan instead of considering how small the monthly installment seems.

- Personalized Budget Planning: By inputting your own income, liabilities, and financial goals into the calculator along with the details of different offerings, you can simultaneously view the implications of all choices, thus making sure that the loan fits in with your lifestyle and income stability.

Common Mistakes to Avoid When Using EMI Calculators

There are several common mistakes to avoid when using an EMI calculator in the UAE, including not entering the interest rate accurately, incorrectly entering the original loan amount or the number of years, and some people make the mistake of not taking into account additional fees and other details.

Impact of Loan Tenure and Interest Rates on EMI

The following table shows how loan term and interest rates affect your monthly loan payments:

- Longer Tenure Means Lower EMI: With a longer loan tenure, the EMI is lower; so, in the short term, repayments are more affordable, but one ends up paying more interest with this option over the actual life of the loan.

- Shorter Tenure Means a Lesser Interest: With a shorter tenure, one has to pay a higher EMI per month; however, in the end, one ends up paying much lesser interest, thereby a viable option if one can handle it.

- Lower Interest Rate, Higher EMI: A higher annual interest rate will increase the monthly EMI and the total amount to be repaid; hence, it is better to well compare the rates of various banks before taking any loan offer.

- With Low Interest Rates, One Can Save Finally: A little difference in interest rates can lead to monthly EMI reductions and total cost deductions. This certainly translates to a lot of saving over several years.

- The Combined Impact Will Ensure Affordability: The tenure of the loan and the interest rate together decides the EMI. A slightly inferior rate for a few more years can even prove more expensive as balanced consideration should hold both factors in favor of the applicant.

Additional Costs not Reflected in EMI Calculators

Below is a list of additional costs not reflected in EMI calculators:

- Processing and Administrative Fees: A amount charged, in most banks in the UAE, is generally 1% of the amount of loan. This is paid upfront and not included under EMI calculators, which could dent out greatly when calculating the initial cash outflow at the time of disbursement of the loan.

- Insurance Charges: The package of most personal and car loans includes life or loss of job type insurance policies. Tested online EMI calculators do not take these charges into account unless they are manually inputted into the system. These charges may be deducted upfront or added to your EMI.

- Late Payment and Prepayment Penalties: Penalties for missed payments and penalties for prepayment are not taken into consideration by EMI calculators. These penalties differ from bank to bank and can make your overall expense higher if they are not considered at the time of planning for your loan.

Tips for Reducing Your EMI Burden

Here are some tips for reducing your EMI Burden:

- Choose a Longer Loan Tenure: Suppose you take the risk of extending the tenure of a loan. Your responsibilities decrease in terms of giving out monthly EMIs. However, the borrower should be aware that by retaining a loan for a longer time, the exact final amount of interest to be paid increases tremendously.

- Negotiate a Low Interest Rate: From the outset, prepare a true comparison of interest rates among lenders. A small low can mean major savings on monthly EMI, especially if it is a large loan amount or loan opposed for a long period.

- Make a Bigger Down Payment: A higher down payment means a lower loan principal and therefore less in monthly EMIs. This view is quite helpful in car or house loans where down payment is generally flexible.

- Select a Loan That Grants You Flexibility in Repayments: Some banks in the UAE offer some kind of EMI arrangements such as step-up and balloon payments that benefit you by paying lower EMIs upfront when your income is at an initial stage.

- Through Refinancing of Loan: Refinancing through an alternate lender can reduce EMIs and total cost of borrowing when interest rates fall or your credit profile improves. However, carefully assess processing fees or switching costs before you go ahead.

Questions & Answers

The UAE EMI Calculator is used to easily find out loan details without the need for manual calculations.

The data required for the UAE EMI Calculator is limited to the loan amount, the interest rate or Murabaha, and the number of years.

Yes, the UAE EMI Calculator does provide accurate results.