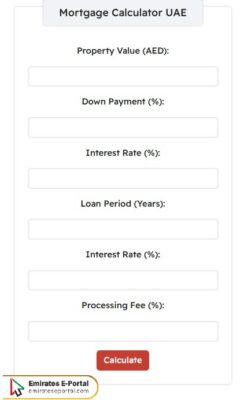

Mortgage Calculator UAE – Calculate Your Home Loan Easily

With the following calculator, you can calculate all the details of the mortgage with great accuracy & speed:

Approximate Monthly Cost AED

Cost Breakdown AED

Financing Details AED

Financial Breakdown Pie Chart

Yearly Repayment Schedule AED

| Year | Principal | Interest Paid | Principal Paid | Balance Amount | Loan Amount Paid (%) |

|---|

How to Use a Mortgage Calculator in the UAE

To use a mortgage calculator in the UAE, Here’s how to do it:

- Write the Property Value in AED in the empty field.

- Enter the Down Payment percentage and then write the Interest Rate percentage.

- Enter in years and then add the interest rate.

- Type Processing Fee and then click on the Calculate icon.

- View all mortgage details in the UAE based on the result displayed by the calculator.

Example of How to Calculate a Mortgage in the UAE

Suppose you want to buy a property in Dubai worth AED 1,000,000, and you are an expat required to pay a 20% down payment, with a bank offering a fixed interest rate of 3.5% per annum for a 20-year tenure. Here is how to calculate mortgage:

- Property Price = AED 1,000,000

- Down Payment (20%) = AED 200,000

- Loan Amount (80%) = AED 800,000

- Interest Rate (Fixed) = 3.5% per annum

- Loan Tenure = 20 years = 240 months

- Approximate Monthly EMI = AED 4,630

- Total Repayment Over 20 Years = AED 4,630 × 240 = AED 1,111,200

- Total Interest Paid = AED 1,111,200 – AED 800,000 = AED 311,200

Basic Inputs for Mortgage Calculator in UAE

The following list shows the basic inputs for mortgage calculator in the UAE:

- Property Price: The full cost of the property you wish to purchase. This price is taken as the basic value for calculating the down payment & the loan amount in the mortgage calculator.

- Down Payment: By UAE regulations, the minimum down payment is fixed at 20% of the value for expats & 15% for UAE nationals. The down payment subtracts from the principal loan amount, & hence, affects your monthly payments.

- Loan Tenure: The duration over which you wish to repay your mortgage, usually 25 years in the UAE, affects your EMI & the total interest paid.

- Interest Rate: The annual interest rate is fixed or floating & decides the amount you have to pay every month. Even a small difference in interest rate might hugely alter the EMI set over a period.

Eligibility Criteria for Mortgages in UAE

Eligibility criteria for mortgage loans in the UAE vary from one entity to another. These include being at least 21 years old and not exceeding the maximum age limit imposed by the bank, having a stable source of income, a good credit rating, and residing in the UAE. Some loans require additional conditions.

Types of Sharia-Compliant Mortgages in UAE

Below is a list of types of sharia-compliant mortgages in the UAE:

- Murabaha Mortgage: The bank buys the property & sells it to the buyer at a marked-up price. The buyer then repays in fixed installments without paying traditional interest.

- Ijara Mortgage: The bank purchases the property & leases it to the customer. Payments are treated as rent, & ownership is transferred after the final installment is paid.

- Musharakah Mortgage: A partnership where both the bank & buyer are owners of the property. The buyer gradually gains ownership of the property by buying out the bank share while residing therein.

- Takaful-Linked Mortgages: These mortgage types are linked with an Islamic insurance arrangement (Takaful) that protects against default or death, thus conforming to Sharia law.

- Hybrid Islamic Mortgages: Some banks combine Ijara & Musharakah to provide more flexible repayment terms tailored to customer construction.

Mortgages Loan-to-Value (LTV) Ratios & Their Impact on Borrowing

Lower LTV ratio also means a higher down payment, reducing monthly EMI and interest costs. High LTV loans may look easier to get at first, but almost all of these loans require stricter approval criteria, hence affecting long-term affordability due to their potential to carry higher interest rates.

Mortgages Additional Costs in the UAE: Fees, Insurance, and Taxes

The list below includes mortgages additional costs in the UAE:

- Processing Fees: The one-time processing fee is mostly between 0.5% & 1% of the loan amount, which has to be paid upfront at the time of mortgage application.

- Property Registration Fees: The Dubai Land Department charges a registration fee of 4% based on the value of the property, making it a large amount to consider.

- Valuation Fees: The property has to be valued professionally, normally costing between AED 2,500 & AED 3,500, & it is not refundable should the mortgage be disapproved.

- Life & Property Insurance: Insurance of life & property is usually required by the banks under mortgage engagements, with these being annual recurring costs to the mortgage.

- Early Settlement Charges: If repaying the loan before time is the lesser option chosen by you, there may be a charge by banks of about 1% peg outright loan amount for this penalty, which will weigh down on your cost-saving strategies.

Mortgage Options for First-Time Homebuyers in UAE

The following list shows mortgage options for first-time homebuyers in the UAE:

- First-Time Buyer Programs: Different banks offer different schemes for the first-time buyer; usually, these include concessions on down payments, lower rates, or fee waivers to ease the path into homeownership.

- Fixed-Rate Mortgage: With this, you pay the same mortgage every month-intensive on a fixed period-which is ideally suited for first-time buyers who wish to keep their expenses predictable for at least some duration of the early years of owning a home.

- Variable-Rate Mortgage: For the buyers expecting that interest rates will go down, variable-rate loans are available; and, fluctuating EMI for such loans remains the risk for those with strictly budgeting limitations.

- Government Housing-Related Schemes: The nationals of the UAE may be entitled to government-funded or subsidized home loans under schemes like the Sheikh Zayed Housing Program.

- Developer-Mortgage Offers: Most major UAE developers partner with banks to offer really good mortgage packages to first-time buyers, which have very long grace periods and carry minimum upfront costs.

Tips for Getting the Best Mortgage Deal in UAE

Here are some tips for getting the best mortgage deal in the UAE:

- Improve Your Credit Score: More creditworthy applicants get better rates & loan terms. Monitor & maintain your credit history regularly.

- Shop Around For the Best Loan: Never accept the first offer. You might want to check at least three to five banks in terms of interest rates, fees, & repayment flexibility before you make your choice.

- Bargain For The Interest Rate: There’s usually some room for negotiation with a bank. Depending on your level of income, your indebtedness, & the length of your banking relationship, ask for the rate to be reviewed.

- Decide on the Tenure: Balance EMI affordability with overall interest charges. Shorter tenure equals higher EMI but saves money over the term given that less interest accrues.

- Beware of The Hidden Charges: Do go through all the fine prints that come with the loan offers. Know all the fees from early settlement penalties to insurance cost just so you won’t encounter any unwelcome surprises in the time to come.

Questions & Answers

Mortgage calculators are digital tools that do a quick estimate of your monthly loan repayments from key inputs like property price, down payment, interest rates, and loan tenure. They give a quick overview of affordability.

While close to accurate, the final amount can always change from one bank to another, depending on the structure of interest, additional fees, and your credit profile. Always double-check before trusting a lender with your money.

Most online calculators do not include processing fees, insurance, valuation, and property registration costs. In order to make a complete estimation, add these costs after you use the calculator.