Personal Loan EMI Calculator UAE – Know Your EMI Instantly

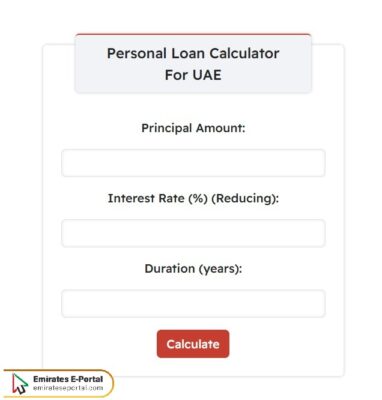

You can use the following calculator to know the details of your Personal Loan EMI in the UAE:

Approximate Monthly Cost: AED

Interest (AED): AED

Loan Amount (AED): AED

Principal Amount (AED): AED

Interest Rate: %

Duration (Months): Months

Total Interest Amount (AED): AED

Total Payable Amount: AED

How to Calculate Personal Loan EMI in UAE

Personal Loan EMI is calculated based on the principal amount of the loan, the interest rate (Murabaha), and the repayment period. The higher these criteria, the higher the repayment amount and other details. Individuals should use calculators to easily determine the exact details of their personal loan while avoiding potential human errors.

How to Use a Personal Loan EMI Calculator in UAE

To use a personal loan EMI calculator in the UAE, Here’s what you need to do:

- Type the Principal Amount in the field provided.

- Enter the interest rate for the loan.

- Write the duration in years and then click Calculate.

- Check loan details.

Benefits of Using an EMI Calculator Before Applying

The following list highlights the main benefits of using EMI Calculator Before Applying:

- Accurate Monthly Budgeting: By use of an EMI calculator, you can estimate the monthly installments with precision & can thus plan your finances better, avoiding any over commitment from your salary or monthly inflow.

- Better Loan Comparisons: Put different inputs regarding loan amounts, tenures, or rates of interest to check out various offers. That way, you can ensure choosing the personal loan that is most cost-effective in your scenario.

- Avoid Surprises Later: Calculators will show you the total amount to be repaid inclusive of interest, & this degree of transparency prevents future financial surprises or underestimation of the actual amount of repayment you will be engaging in throughout the loan tenure.

- Faster Decision-Making: With the result being instantaneous, the EMI calculators reduce the amount of time required to judge affordability, making it easier to decide whether to commit to an application or pursue other options.

- Enhanced Negotiation Power: Having a clear idea about your expected EMI will help you in negotiating confidently with your lender on rates, tenures, or fees that are based on your own realistic financial expectations & affordability.

Example of calculating Personal Loan EMI in UAE

Suppose you apply for a personal loan of AED 100,000 at a flat interest rate of 5% per annum for a loan tenure of 4 years. Here is how to calculate the monthly installment:

- Loan Amount = AED 100,000

- Flat Interest Rate = 5% per annum

- Loan Tenure = 4 years = 48 months

- Total Interest = AED 100,000 × 5% × 4 = AED 20,000

- Total Repayment Amount = AED 100,000 + AED 20,000 = AED 120,000

- Monthly EMI = AED 120,000 ÷ 48 = AED 2,500

Key Factors Influencing Your Personal EMI

Here are the main factors affecting your Personal EMI:

- Interest Rate: The EMI amount depends on the kind of interest & interest rate itself. Just 1 percent margin saves or costs you a lot when it is widely spread over a longer period of repayment of 1–5 years.

- Principal Amount: The basic amount you borrow towards your EMI forms an important aspect. In short, the larger your loan amount, the greater the amount of EMI to be paid on a monthly basis. So, only seek what you are comfortable in repaying within the stipulated time period set out in your loan contract.

- Loan Tenure: The longer the tenure, the lesser is the EMI one has to pay but interest becomes more, while a short tenure implies a higher EMI but cheaper cost of the loan.

- Type of Interest (Flat vs. Reducing): Flat-rate interest loans calculate interest on the amount taken as a loan, while reducing-rate interest loans calculate interest on the balance outstanding. Whatever interest you select will directly influence your final amount & EMIs.

- Processing & Other Fees: Banks very well like to pack processing charges, insurance fees, VAT, etc. into the loan amount. This means a slight increase in the EMIs you have to pay. If you ignore such charges, you run the risk of something unexpected creeping into your repayments.

Eligibility Criteria for Personal Loans in UAE

Postulated age criteria for personal loans in the UAE for applicants is 21 to 65 years, employed with a listed company. Salary criteria vary between banks, from a minimum AED 3,000 to AED 5,000 per month. Apart from these, loan approval requires a valid Emirates ID, valid residency visa, salary certificate, and recent bank statements.

Common Mistakes to Avoid When Calculating Personal EMIs

The following list highlights several common mistakes to avoid when calculating Personal EMIs:

- Forgoing Processing Fees & VAT: Many users calculate EMIs considering only the principal & interest, completely neglecting other fees such as processing charges & VAT, which may increase the monthly outflow.

- Incorrect Tenure Selection: Selecting tenures on either extreme without considering the ramifications can skew the EMI results. Shorter tenures are great but maybe beyond the affordability level for offers, while longer tenures just unnecessarily increase the interest.

- Using the Wrong Interest Type: Some people end up confusing flat interest with reducing interest. Flat rates look attractive, but total repayment becomes more, hence misguiding people as to the real cost of the loan.

- Not Updating Salary or Liabilities: Most EMI Calculators assume steady income. If the user undergoes a change in financial situation somewhere down the road, say takes on another liability, the affordability of his EMI also changes, very much putting an obsolete tag on the calculator value.

- Not Comparing All Banks: Sticking to one calculator means that you may well miss out on a better deal. Always try to compare across banks for the best loan terms.

Tips for Reducing Your Personal EMI Burden

The following list includes several tips to reduce your Personal EMI burden:

- Lengthen Your Tenure: Increasing loan tenure decreases monthly EMIs, thereby aiding in cash flow management; however, be mindful that a longer tenure increases total interest accumulated over the life of the loan.

- Go for Partial Prepayment: Make a lump-sum prepayment in case of any bonuses or extra income. This cuts the principal & can majorly lessen your EMIs in the future or cut down your loan tenure.

- Improving Your Credit Score: The higher the credit score, the better the chances for low-interest rates. A minute decline in rate would tremendously impact the total EMI paid over time.

- Rate Negotiating: If you have a stable income or banking relationship, negotiate with your bank for better rates before accepting any offer because lower rates automatically mean lesser EMIs.

- Don’t Accept Any Add-ons & Insurance Bundling: Some lenders roll in an insurance premium or add-ons in the loan amount, thereby increasing your EMI. Say “no” to these extras & keep your EMI strictly limited to your true borrowing requirement.

Questions & Answers

Factors affecting the Personal Loan EMI calculation in UAE include the loan amount, the repayment term, and the interest rate or Murabaha.

The Personal Loan EMI calculation in UAE can be done using a dedicated calculator or by manually calculating the annual interest rate, then multiplying it by the number of years and adding the result to the loan amount.

Using the Personal Loan EMI calculator in UAE helps you quickly and accurately determine all loan details.