Car Loan Calculator UAE 2026 – Estimate Your Monthly Payments

The following calculator helps you find out the details of a car loan in the UAE:

Approximate Monthly Cost: 2182.97 AED

Loan Amount: 20787.76 AED

Interest: 5407.89 AED

Total Payable: 26195.65 AED

Yearly Repayment Schedule

| Year | Principal | Interest Paid | Principal Paid | Balance Amount | Loan Amount Paid (%) |

|---|

How to Calculate Car Loan in UAE

Car loans in the UAE are calculated based on the original price of the car plus processing fees & the Murabaha or interest value multiplied by the number of years of the loan & then by the original value of the car. The initial payment is also included in the calculation & reduces the price of the car, which is also the basis for calculating the Murabaha or interest.

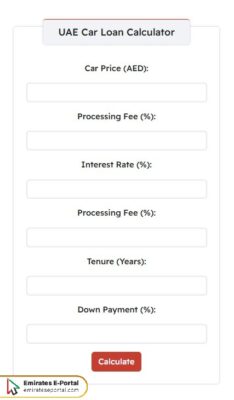

How to Use UAE Car Loan Calculator

To use UAE car loan calculator, Just follow these easy steps:

- Enter the car price and then enter the Processing Fee.

- Enter the Interest Rate and then write the Processing Fee.

- Add the number of years and then write the Down Payment Rate.

- Click on the Calculate icon to view loan details.

Example of Calculating Car Loan in the UAE

If you want to purchase a car worth AED 100,000 with a 20% down payment, you have AED 80,000 left over for financing. In this case, the bank offers a fixed interest rate of 3% per annum over 5 years. You can calculate the loan details as follows:

- Loan Amount = AED 80,000

- Interest Rate = 3% flat per annum

- Loan Tenure = 5 years

- Total Interest = AED 80,000 × 3% × 5 = AED 12,000

- Total Repayment = AED 80,000 + AED 12,000 = AED 92,000

- Monthly Installment = AED 92,000 ÷ 60 months = AED 1,533.33

Key Factors that Affect your Car Loan Repayment in the UAE

Here is a list of the main factors that affect your car loan repayment in the UAE:

- Loan Amount: How much you borrow affects your monthly installment. If you take a bigger loan, your debt repayments go up; alternatively, a smaller amount means you pay fewer installments every month, and the interest thereon will be comparatively less throughout the loan period.

- Interest Rate: Be it a flat rate or a reducing one, the interest rate is a big player in deciding how much you need to repay. A low-interest rate will reduce your overall cost, while higher interest rates mean more significant monthly payments and larger amounts to be discharged over the loan duration.

- Loan Tenure: The longer the tenure, the lesser will be your monthly payment, but the more will be the interest paid. With a shorter tenure, installments will be higher but comparatively less will be paid in the long run.

- Down Payment: Down payment is the money paid up-front, which affects the size of the loan. A big down payment reduces the principal that one is going to need to borrow, and thus, a lower amount of monthly repayments will have to be made, along with less total interest paid over time.

- Credit Score: Your credit score governs the terms offered to you on any loan by the banks. A good credit score unlocks lower interest rates and better repayment options, whereas a lower score increases cost or outright rejection.

Islamic vs. Conventional Car Loans in UAE

An Islamic car loan in UAE follows Shariah principles & usually uses structures like Murabaha or Ijara, whereby, for instance, the bank will buy the car & sell it to the customer at a certain profit or lease it to the customer. Conventional loans, on the other hand, charge interest on the money borrowed. The choice depends on your financial beliefs, repayment preference, & how each options fare in flexibility with fees & tenure.

Minimum Salary and Eligibility Requirements for Car Loan in UAE

Most firms in the UAE require a minimum monthly salary to be anywhere between AED 3,000 & AED 5,000 to qualify for a car loan. The applicant must have a valid Emirates ID & salary certificate & should be able to show recent bank statements. Eligibility varies between expats & UAE nationals, & factors like credit score, listing of employer, & current liabilities also play a role in approving or disapproving an application.

Tips to Get the Best Car Loan Deal in UAE

The following list includes several tips for getting the best car loan deal in the UAE:

- Evaluate Multiple Lenders: Always weigh offers from various banks and finance companies. Charging interest is just part of it-these lenders may charge inception or processing fees, prepayment penalties, insurance, etc. Factor in all of these other elements to ascertain the loan’s real cost.

- Look At Your Credit Score Before Applying: Check your credit score with AECB before applying for a loan. Higher scores help in the better loan terms, lower interest rates as well as flexible repayment terms, so it pays to clear off any outstanding debts.

- Negotiate for a Better Interest Rate: Never settle for the first offer. Most banks are quite flexible when it comes to negotiations, especially if you have a good payout or its current banking relations. So do feel free to ask for a discount or special rate for either flat or reducing interest.

- Opt for a Shorter Loan Tenure: Payment is low if a tenure is long but so is the total interest. Of course, if you can afford to pay more each month, it is best to cut back on the loan term.

- Pay More as Down Payment: A hefty down payment will bring down on loan amount, so monthly installments and interest too will get lower. This also reflects on one’s willingness and ability to meet financial obligations, increasing approval odds and favoring better terms.

Questions & Answers

No, the interest rate on car loans in UAE varies greatly from one bank to another, and it also varies within the same bank based on several factors.

The factors affecting car loans in UAE include the number of years, the initial payment amount, and the profit or interest rate.

Car loans in UAE can be obtained through car showrooms, banks, and other financing providers.