VAT Calculator UAE Online 2026 – Accurate & Simple

Quickly calculate your Value Added Tax with this easy-to-use UAE VAT calculator:

VAT in UAE

Value-added tax (VAT) in the UAE can be defined as an indirect consumption tax imposed by the government on most supplied goods and services. It is repeated at every stage of the supply chain until it reaches the final consumer, who bears the full cost. Companies and institutions calculate and collect the tax on behalf of the government.

How to Calculate VAT in UAE

VAT in the UAE is calculated by multiplying the price of the good by 5% and then adding the result to the basic price. If the good is supplied again, the price resulting from the previous supply is multiplied by 5% and the result is added to the price again. This is done throughout the supply chain until it reaches the final consumer in the country.

How to Use UAE VAT Calculator

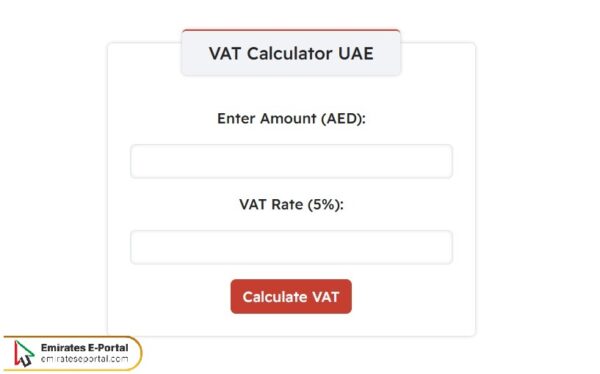

Here’s how to use the UAE VAT calculator online:

- Write the value of the item in the empty field above.

- Enter the VAT Rate of 5% in the lower field.

- Click on the Calculate VAT icon.

- View the value of VAT and the price of the item after adding it.

Example of Calculating VAT in the UAE

Here are some examples of VAT calculations in the UAE:

- How much is the VAT on a product priced at AED 120 if it is supplied twice?

- VAT after the first supply = 120 x 5% = AED 6

- Price of the product after the first supply = 120 + 6 = AED 126

- VAT after the second supply = 126 x 5% = AED 6.3

- Price of the product after the second supply = 126 + 6.3 = AED 132.3

- If a product is supplied four times and its original price is AED 500, how much VAT is charged on it?

- VAT after first supply = 500 x 5% = AED 25

- Price of the item after VAT for the first time = 500 + 25 = AED 525

- VAT after second supply = 525 x 5% = AED 26.25

- Price of the item after VAT for the second time = 525 + 26.25 = AED 551.25

- VAT after third supply = 551.25 x 5% = AED 27.5625

- Price of the item after VAT for the third time = 551.25 + 27.5625 = AED 578.8125

- VAT after fourth supply = 578.8125 x 5% = AED 28.940625

- Price of the item after VAT for the fourth time = 578.8125 + 28.940625= AED 607.753125

- How much VAT is due on a product supplied once and its original price is AED 200?

- VAT after first supply = 200 x 5% = AED 10

- Price of the item after VAT for the first time = 200 + 10 = AED 210

VAT Registration Criteria in UAE

The following list outlines the criteria for VAT registration in the UAE:

- Mandatory registration:

- The total value of its taxable supplies and imports during the preceding twelve (12) months exceeded the mandatory registration threshold, or the business expects the total value of its taxable supplies and imports during the next thirty (30) days to exceed the mandatory registration threshold.

- The mandatory registration threshold is AED 375,000. This threshold does not apply to foreign businesses.

- Optional registration:

- The total value of its taxable supplies and imports, or the total value of its taxable expenses during the preceding twelve (12) months, exceeded the voluntary registration threshold, or the business expects the total value of its taxable supplies and imports, or the total value of its taxable expenses, during the next thirty (30) days, to exceed the voluntary registration threshold.

- The voluntary registration threshold is AED 187,500.

The Difference Between VAT and Sales Tax in UAE

Sales tax is imposed on the final sale stage alone and is linked to goods only. Value-added tax, on the other hand, is imposed on goods and services at each stage of supply. This means that it increases with the number of supply stages, while its value is lower when it is limited to a few these stages.

Supplies Exempt From VAT in the UAE

The following list includes supplies exempt from VAT in the UAE:

- Supply of financial services specified in the executive regulations of this Decree-Law.

- Supply of residential buildings through sale or lease, except for those subject to a zero-rated tax rate, as follows:

- The first supply of residential buildings within three (3) years of the date of completion of construction, through sale or lease, in whole or in part, in accordance with the controls specified in the executive regulations of this Decree-Law.

- The first supply of buildings specifically designed for use by charitable organizations, through sale or lease, in accordance with the controls specified in the executive regulations of this Decree-Law.

- Supply of vacant land.

- Supply of local passenger transportation services.

When is the Zero-Rated VAT Applied in UAE

The zero rate of VAT in the UAE applies to the following:

- The direct or indirect export of goods and services outside the implementing countries, as determined by the executive regulations of this Decree-Law.

- International passenger and cargo transport services that originate in, terminate in, or transit through the State, including services associated with such transport.

- Air passenger transport within the State, if such transport is considered “international” in accordance with Article (1) of the Warsaw Convention for the Unification of Certain Rules Relating to International Carriage by Air of 1929.

- The supply or import of air, sea, and land means of transport used for the transport of passengers and goods, in accordance with the classification and conditions determined by the executive regulations of this Decree-Law.

- The supply or import of goods or services related to the means of transport mentioned in Clause (4) of this Article and intended for their operation, repair, maintenance, or conversion.

- The supply or import of aircraft or vessels for rescue and assistance by air or sea.

- The supply of goods and services related to the transportation of goods or passengers on air, sea, or land transport, in accordance with the provisions of Clauses (2) and (3) of this Article, and intended for consumption on board, or consumed by any means of transport, or any installation or insertion thereof, or any other use during the transport process.

- The supply or import of precious metals for investment purposes. The Executive Regulations of this Decree-Law on Precious Metals shall specify the criteria for considering them as investment metals.

- The first supply of residential buildings, which shall take place within three (3) years from the date of completion of construction, shall be through their sale or lease, in whole or in part, in accordance with the controls specified in the Executive Regulations of this Decree-Law.

- The first supply of buildings specifically designed for use by charitable organizations, through their sale or lease, in accordance with the controls specified in the Executive Regulations of this Decree-Law.

- The initial supply of buildings converted from non-residential to residential buildings, through sale or lease, in accordance with the conditions specified in the executive regulations of this Decree-Law.

- The supply or import of crude oil and natural gas.

- The supply of education services and related goods and services to nurseries, pre-primary education, and basic education institutions, as well as higher education institutions owned or funded by the federal or local government, in accordance with the provisions of the executive regulations of this Decree-Law.

- The supply of preventive and basic healthcare services and related goods and services, and the import of related goods, in accordance with the provisions of the executive regulations of this Decree-Law.

Questions & Answers

The VAT rate in the UAE is 5% of the value of the good or product.

No, VAT in the UAE is paid repeatedly for each stage of supply.

Businesses pay VAT in the UAE to the government during the supply stages, and it is ultimately borne by the end consumer.