UAE Gratuity Calculator 2026: Updated with Labour Law

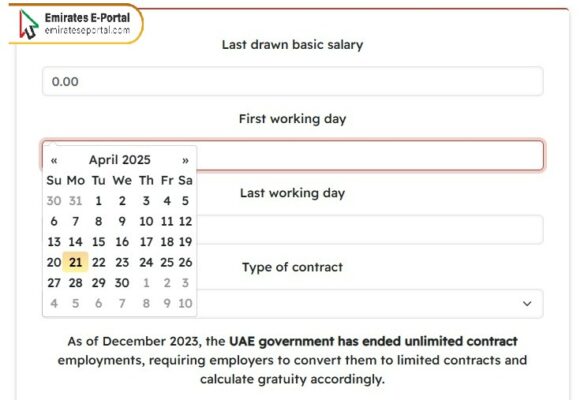

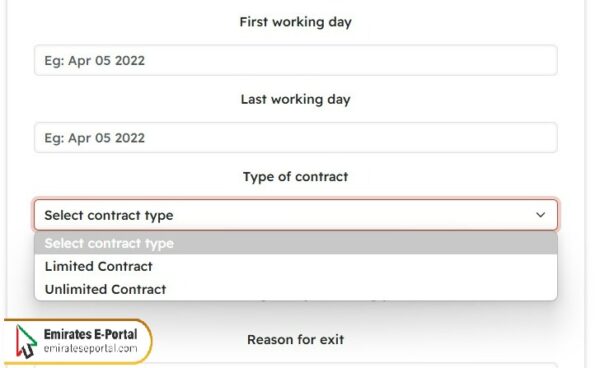

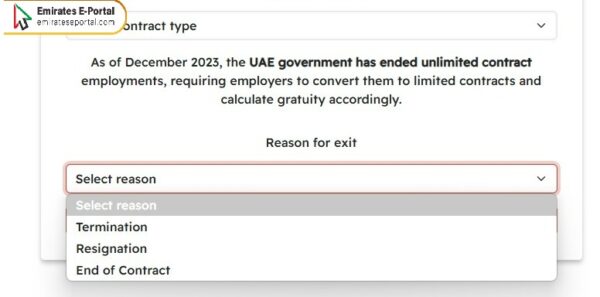

You can calculate your Gratuity depending on UAE labor law via the following Calculator:

What is Gratuity in UAE

UAE law entitles every employee to an end-of-service gratuity (EOS) payment, also known as Gratuity, after at least one year of service. When calculating length of service, days of unpaid absence are not counted, and employers may deduct any amounts owed by the employee from the EOS payment. EOS payment in the UAE is calculated based on 21 days’ pay for each of the first five years of service, and 30 days’ pay for each additional year.

How to Use UAE Gratuity Calculator

You can use UAE Gratuity Calculator to calculate your end-of-service gratuity by following the steps bellow:

- Input your

- Select your

- Select your Last

- Select the

- Select the

- Click “Calculate Gratuity“.

How Gratuity in UAE is Calculated for Limited Contract

The Formula used for the Calculation of Gratuity for Limited Contract is as following:

- Daily wage = Elementary pay ÷ 30.

- 1-year gratuity owed = Daily wage x 21.

- Total gratuity owed = 1-year gratuity owed x years of service.

How to Calculate Gratuity in UAE for Unlimited Contract

The Formula used for the Calculation of Gratuity for Unlimited Contract is as following:

- Daily wage = Elementary pay ÷ 30.

- 1-year gratuity owed = Daily wage x 21.

- Total gratuity owed = 1-year gratuity owed x years of service.

- Total gratuity owed ÷ 3 = One-third of total gratuity owed.

- One- third of gratuity owed for 1-3 years of service.

- Two- third of gratuity owed for 3-5 years of service.

- After the end of 5 years, remuneration of the total gratuity owed may occur.

Who is Eligible for Gratuity in UAE

The following are the criteria for an employee to be eligible for end-of-service gratuity in the UAE:

- The minimum length of service must be at least one year of continuous service.

- Continuous service: The employee’s service must be continuous, with certain exceptions for leave.

- Type of contract: Rules differ between fixed-term and unlimited-term contracts.

- Employees who resign before completing one year of service are not entitled to end-of-service gratuity.

Key Factors Influencing Gratuity Calculation in UAE

The following are the factors that affect the method of calculating gratuity in the UAE:

- Basic Salary: End-of-service gratuity is calculated based on the basic salary, excluding allowances, commissions, and any bonuses.

- Years of Service: The number of years of service affects the final amount of the end-of-service gratuity. The longer the service, the higher the gratuity.

- Type of Contract: The method of calculating the end-of-service gratuity for employees with limited contracts differs from that for employees with unlimited contracts.

- Resignation or Termination of Service: An employee’s resignation or termination of service affects their entitlement to end-of-service gratuity under UAE Labor Law.

Gratuity Rules for Unlimited Contracts in UAE

The following are the rules for calculating Gratuity Rules for Unlimited Contracts in UAE:

- In the event of resignation:

- Less than one year of service: Employees are not entitled to an end-of-service gratuity.

- From one to three years of service: Employees are entitled to one-third of their basic salary for each year of service.

- From three to five years of service: Employees are entitled to two-thirds of their basic salary for each year of service.

- After five years of service: Employees are entitled to 21 days of basic salary for each of the first five years of service, and 30 days of basic salary for each additional year of service.

- In the event of termination of service:

- Less than one year of service: Employees are not entitled to any end-of-service gratuity.

From one to five years of service: The end-of-service gratuity is calculated based on 21 days of basic salary for each year of service. - More than five years of service: The end-of-service gratuity is calculated based on 21 days of basic salary for each year of service.

- Less than one year of service: Employees are not entitled to any end-of-service gratuity.

Gratuity Rules for Limited Contracts in UAE

The following are the rules for calculating Gratuity Rules for limited Contracts in UAE:

- Less than one year of service: The employee is not entitled to any end of service gratuity.

- From one to five years of service: The employee is entitled to 21 days of basic salary for each year of service.

- More than five years of service: The employee is entitled to 21 days of basic salary for the first five years of service, and 30 days of basic salary for each additional year.

Common Mistakes in UAE Gratuity Calculations

Here are some mistakes that employees and employers should avoid when calculating their end-of-service gratuity:

- Adding allowances and benefits to the end-of-service gratuity. End-of-service gratuity is calculated based on basic salary only.

- Incorrectly calculating length of service. Ensure that length of service is included to reflect continuous employment only.

- Sometimes, employees and employers misunderstand the type of employment contract, leading to incorrect calculations of the end-of-service gratuity.

Additional Gratuity Benefits in UAE

After the end of service, employees in UAE are entitled to additional end-of-service benefits in addition to their end-of-service gratuity, such as:

- Unused annual leave pay: Compensation for any unused leave.

- Accrued salaries: Employers must repay any outstanding payments before the end of the notice period.

- Other service benefits: These benefits may include allowances for long-term employees based on their employment contract.

Questions & Answers

The online End of Service Gratuity Calculator is a tool that helps organizations in the UAE calculate the end of service gratuity for their departing employees.

Less than 1 Year of Service: Not eligible for gratuity.

1 to 5 Years of service: Gratuity = (Basic Salary/30) x 21 x Years of Service.

More than 5 Years of service: Gratuity = (21 x 5 x Daily wage) + (30 x (Years of service - 5) x Daily wage)

Employees who have served in the UAE for between one and three years are entitled to a full end-of-service gratuity equivalent to 21 days' annual salary. Those who have served for more than three years or between three and five years are entitled to two-thirds of their basic salary as an end-of-service gratuity.

End-of-service gratuity can be paid in advance, and your employer may obtain a signed undertaking from you confirming that you have withdrawn a certain amount. Then, upon your resignation or retirement, your employer will deduct this amount when paying your end-of-service benefits.

1 to 5 Years of service: Gratuity = (Basic Salary/30) x 21 x Years of Service.

More than 5 Years of service: Gratuity = (21 x 5 x Daily wage) + (30 x (Years of service - 5) x Daily wage)